New research from leadership advisory firm Spencer Stuart and modern governance tech provider firm Diligent reveals how nearly 600 global board directors are addressing environmental, social and governance (ESG) and structuring oversight to help their organizations address the opportunities and risks that affect their long-term success.

Seventy-one percent of corporate boards are incorporating ESG objectives and goals into overall company strategy, with 85 percent taking action to increase fluency on ESG, according to the firms’ new report, Sustainability in the Spotlight: Board ESG Oversight and Strategy.

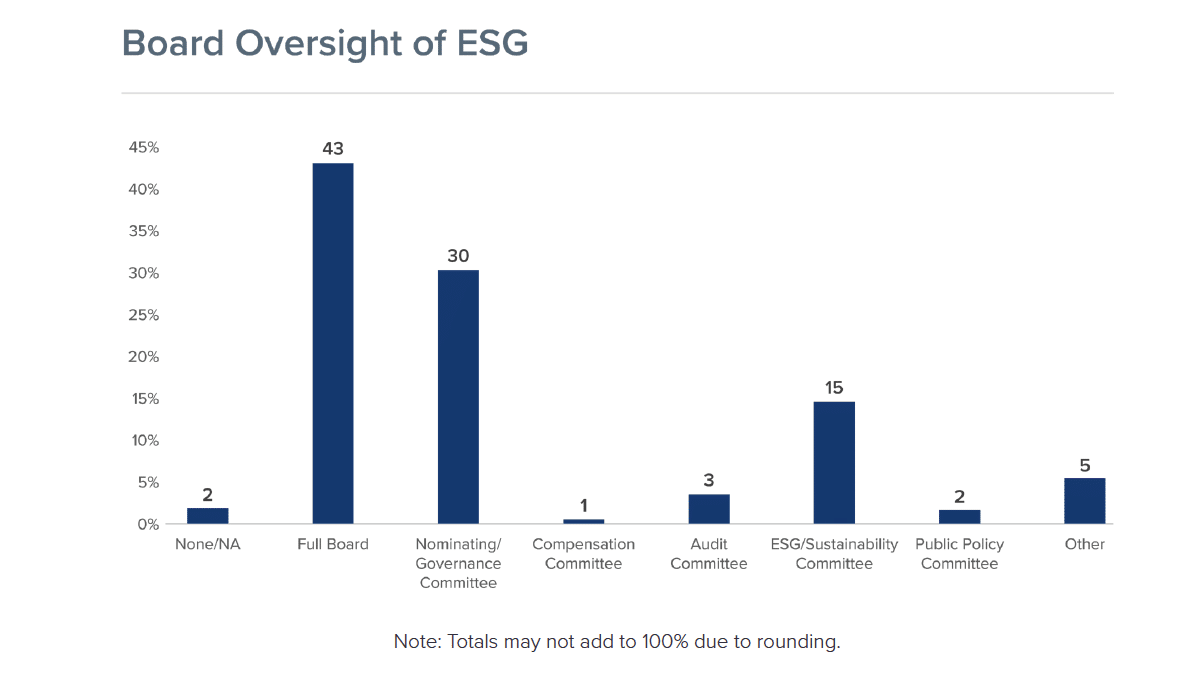

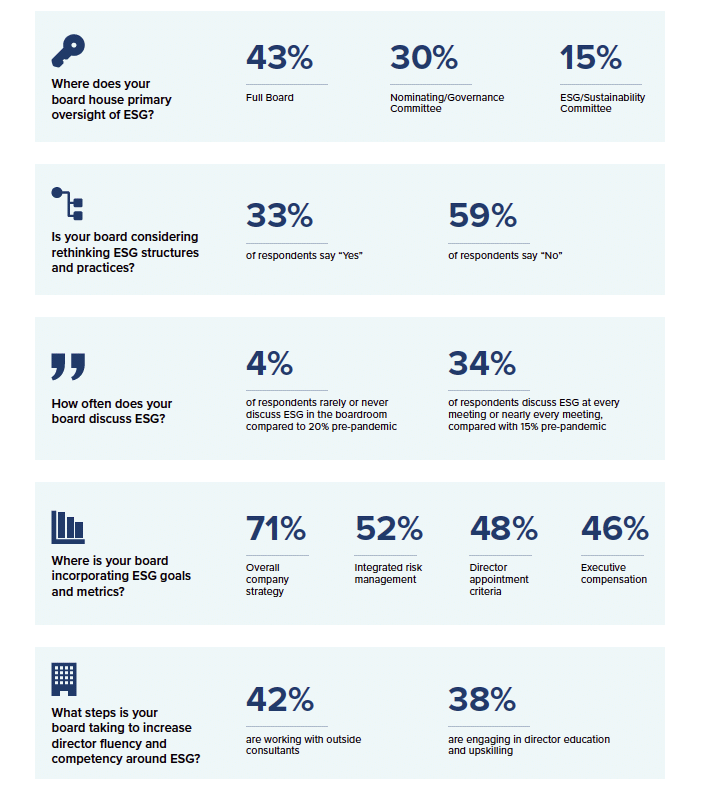

The survey finds that nearly half of boards (43 percent) are placing primary oversight of ESG at the full board level. Meanwhile 30 percent house ESG oversight within the Nominating and Governance committee and 15 percent within the ESG/Sustainability committee, indicating that they may become a more common element of the board committee structure in the future.

“In our work with boards—and in the overwhelming response rate to this survey—we are seeing growing interest in how to best structure oversight of ESG,” said Julie Hembrock Daum, who leads Spencer Stuart’s North American Board Practice, in a news release. “Because little guidance exists, many boards are still figuring out their way forward. The data from this survey provide a fascinating look at how they are doing it.”

Among the top findings:

Relatively few companies have governance structures in place to act on ESG goals

Even as shareholders and other stakeholders increase their focus on ESG, only a third (33 percent) of respondents say their organizations are considering rethinking their ESG structures and practices.

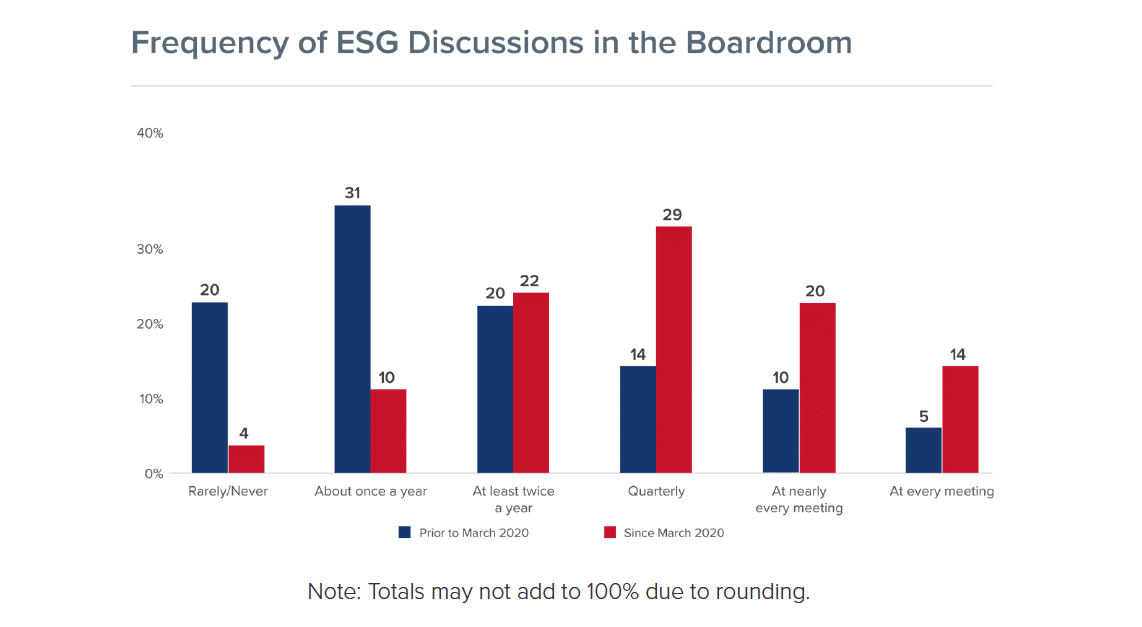

The pandemic has accelerated ESG discussions in the boardroom

Before the pandemic, about 20 percent of respondents said they rarely or never discussed ESG. Two years later, this number is down to 4 percent. Meanwhile, the percentage who say they discuss ESG at every or nearly every meeting has more than doubled, from 15 percent to 34 percent.

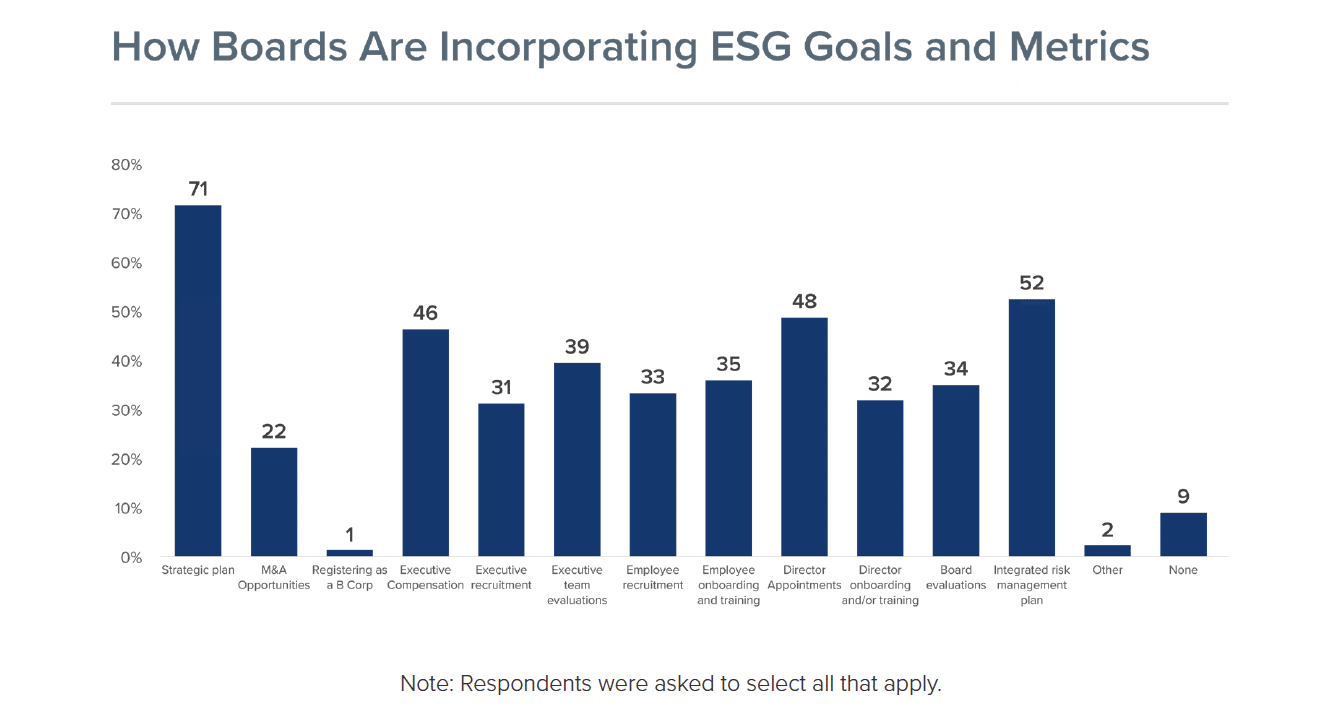

ESG goals and metrics are increasingly incorporated into other elements of business

Seventy-one percent of respondents are incorporating ESG goals and metrics into their overall company strategy. Meanwhile 52 percent are incorporating ESG into integrated risk management, 48 percent into criteria for director appointments, and 46% in executive compensation.

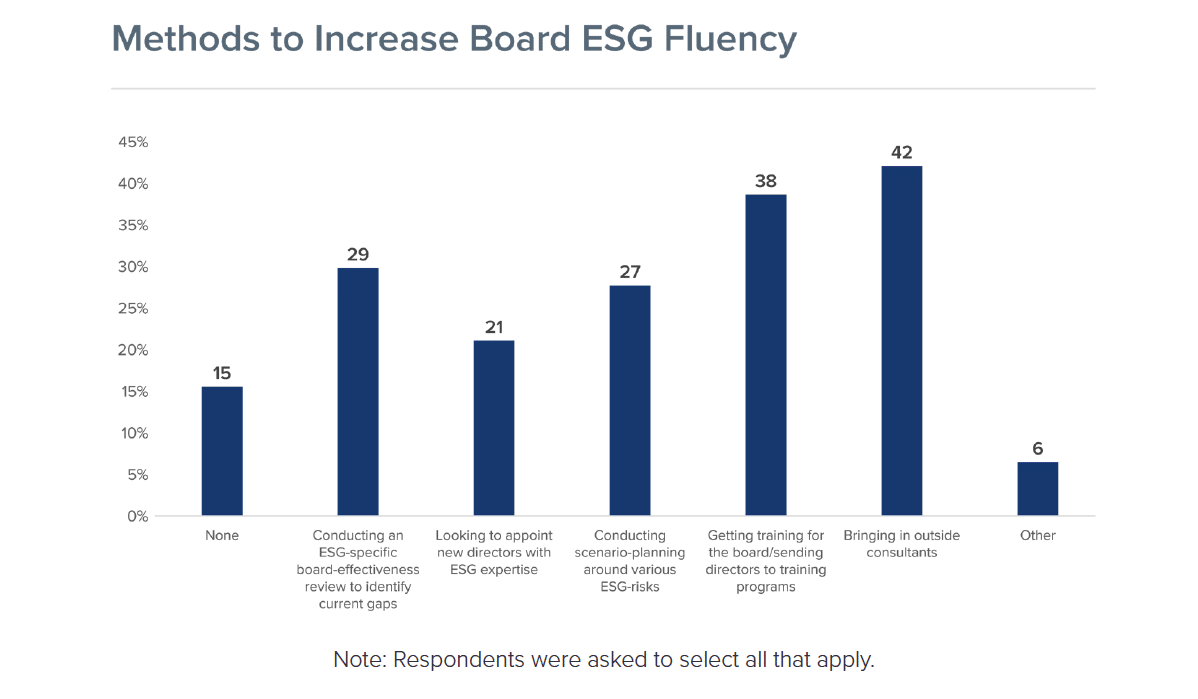

Boards are building their ESG competency

The majority of respondents (85 percent) are taking some action to increase board competency and fluency around ESG, with 42 percent bringing in outside consultants and 38 percent engaging in director education and upskilling.

“ESG has moved from afterthought to strategic imperative, and this survey shows us that the majority of boards understand the importance of setting an ESG strategy to their organization’s long-term success,” said Dottie Schindlinger, executive director of the Diligent Institute, in the release. “However, many organizations struggle with making ESG actionable, and we’re seeing increased demand for education and upskilling to increase board fluency around ESG.”

Download the full report here.

The report Sustainability in the Spotlight: Board ESG Oversight and Strategy is powered by Diligent Institute, the research arm and think tank of Diligent, and Spencer Stuart, a global leadership advisory firm. The findings are drawn from a survey of 590 corporate directors, spanning both public and private companies, conducted globally from February 10 to March 14, 2022. About three-quarters of the respondents (72 percent) represent U.S.-based companies, with the remainder representing companies based elsewhere across the globe. More than three-quarters (78 percent) of respondents represent public companies, with the remainder representing private companies. The survey was promoted globally to Diligent and Spencer Stuart contacts and advertised on social media and in email newsletters.