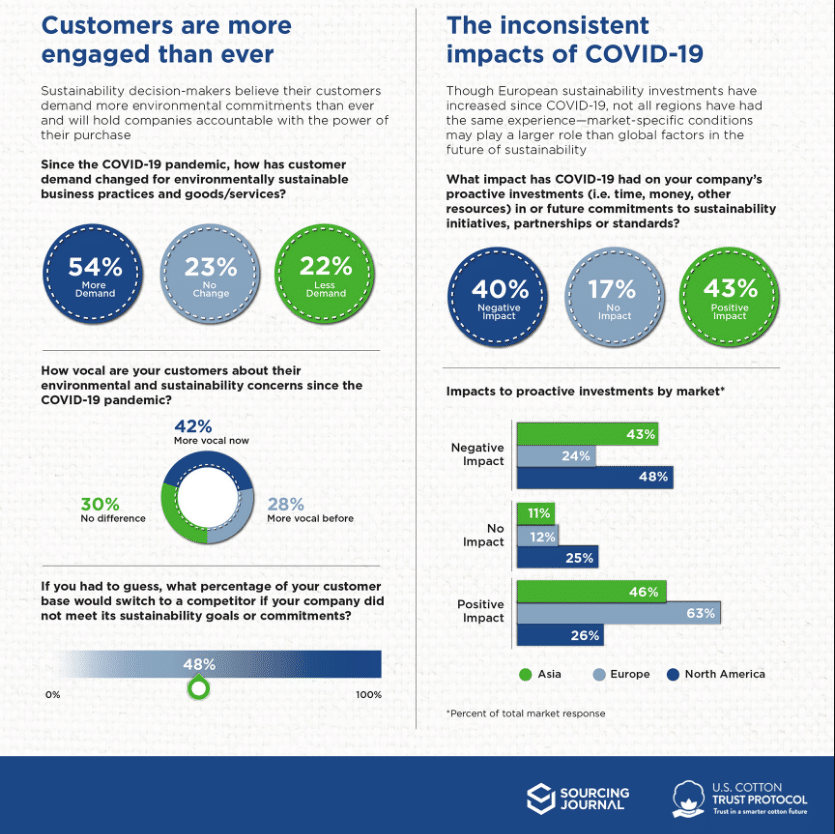

New research from the U.S. Cotton Trust Protocol explores how sustainability programs at brands and retailers has changed in a post-COVID world, revealing that more than half (54 percent) of sustainability leaders at apparel and textile brands say they’ve seen their customers’ demands for environmentally sustainable practices and products increase since the beginning of the pandemic. Meanwhile, 59 percent said they believe customers will still continue to prioritize price when making purchases.

The survey found that 43 percent of respondents believe COVID-19 has had a positive impact on investments in sustainability efforts during this period, while 40 percent believe it has had a negative impact. Likewise, they believe their customers are facing the same struggle between their pocketbooks and the environmental concerns—when asked to rank how they believe customers will prioritize their purchases in the next year, respondents ranked the top two priorities as “Getting the best possible deal” and “Brand or retailer alignment with their personal values.”

“It’s clear that COVID-19 has caused economic challenges up and down the supply chain, but this survey shows that companies and their customers remain focused on sustainability,” said Dr. Gary Adams, president of the U.S. Cotton Trust Protocol, in a news release. “As we enter recovery in many countries, systems like the Trust Protocol will be more important than ever so brands can have the data they need to show they are meeting their science-based targets.”

Vocal customer demand for sustainability

Fifty-four percent of respondents said that their customers’ demands for more environmentally sustainable practices and products has “significantly” or “somewhat” increased since the beginning of the pandemic, and 42 percent said that those customers are also more vocal in those demands. Almost half of all respondents seemed to believe that their customers are more likely to hold them accountable at the register for those actions—almost half (48 percent) said they believed customers would switch brands if their company didn’t meet its sustainability commitments.

Continued focus on sustainability in the supply chain

While some (9 percent) report pausing most or all sustainability initiatives due to COVID-19, most companies continue to focus their sustainability efforts on manufacturing (25 percent), sourcing of raw materials (25 percent) or traceability (11 percent).

European brands continue to invest in sustainability efforts, despite COVID-19

COVID-19’s impact on companies’ investments in sustainability initiatives differs drastically by market—North American respondents are least likely to invest, where only 26 percent of respondents believe COVID-19 has had a positive impact on sustainability investments at their company. While in Europe, six out of 10 (63 percent) respondents said the pandemic has had a positive impact on their company’s sustainability efforts, and in Asia, 46 percent of respondents said they believe there have been increases in proactive investments in sustainability initiatives. With Asian European sustainability initiatives benefiting from the impacts of COVID-19, market-specific conditions may play a larger role in the future of sustainability than global factors.

Many companies are looking for ways to buoy their sustainability programs through the pandemic, focused on holding the course with increased help of outside partnerships (62 percent) until they can afford to reinvest in big new innovations. Meanwhile, they are increasingly focused on improving the transparency in environmental reporting (59 percent); improving sustainability in sourcing (63 percent); and aligning with external sustainability standards or protocols for their existing programs (59 percent).

U.S. Cotton Trust Protocol sponsored the online survey, issued from June 21-July 5, 2020, among 138 senior executives involved in or fully in charge of sustainability decision-making at their company from eight global markets. Respondents were recruited using a combination of Sourcing Journal and an industry-leading panel partner. Results reflect experiences across a diverse range of textile-based industries: Home goods, footwear, accessories, fabrics and apparel.