Brands and businesses of all sizes have experienced impacts from the COVID-19 crisis, but new research finds that many have reportedly pivoted enough in their operations to sustain their business through the crisis so far. A new report from asset management firm Principal Financial Group shares survey results detailing how businesses have responded to the economic effects of the pandemic.

In its seventh edition, the firm’s Well-Being Index gathered insights from 500 business decision makers from companies with up to 10,000 employees for a deeper look at how COVID-19 has affected the way they do business, their workforce, and their plans to recover and move forward.

Businesses are weathering the impacts of COVID-19

“We have to act fast and adapt to be able to diversify in these situations. It is important to have multiple service channels open at all times,” one survey participant offered.

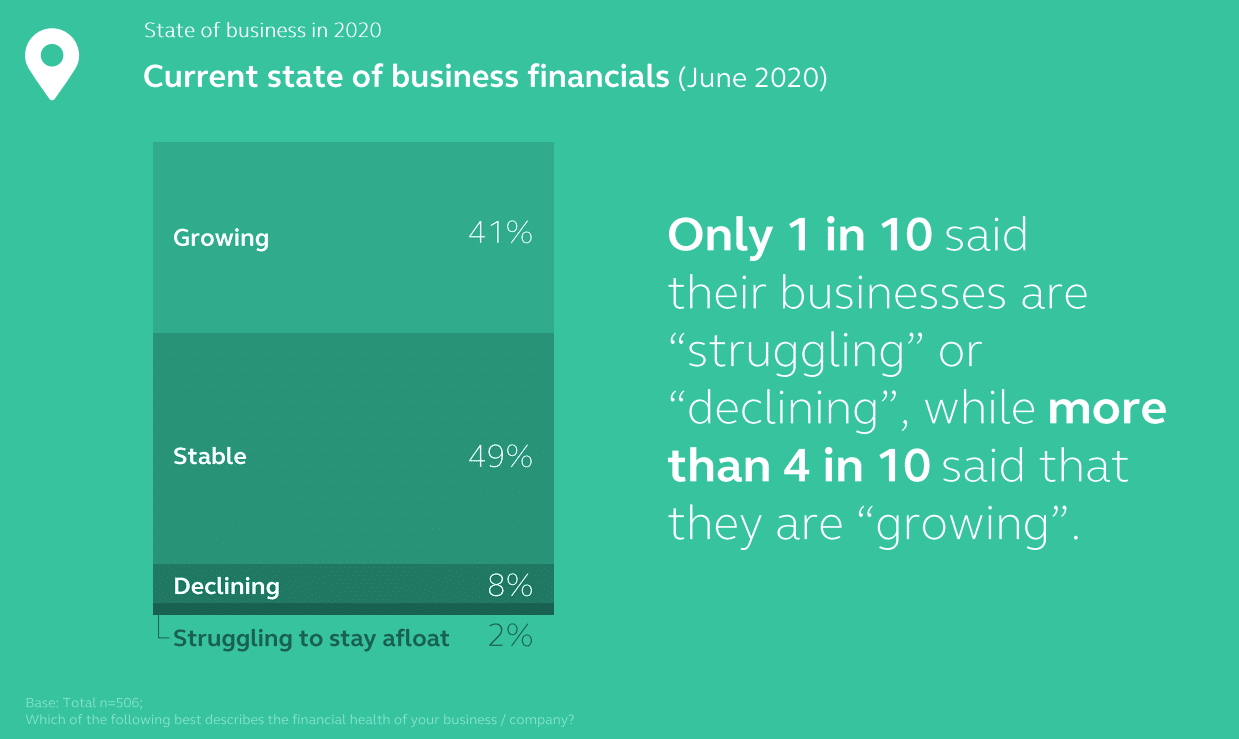

Despite the pandemic significantly altering lives, businesses, and communities around the world, most business surveyed reported feeling positive now halfway through 2020. Only one in 10 respondents indicated they are experiencing a decline in their business’s financial health over the last 12 months. Forty-four percent reported their financials have improved somewhat or significantly in the last year.

“The stamina and strength of business owners in the face of COVID-19 has been remarkable and inspiring,” said Amy Friedrich, president of U.S. Insurance Solutions for Principal, in a news release. “I believe that while most businesses were hit hard initially by the economic disruption caused by the pandemic, many innovated and figured out a way to serve their customers and sustain their businesses in the months that followed.”

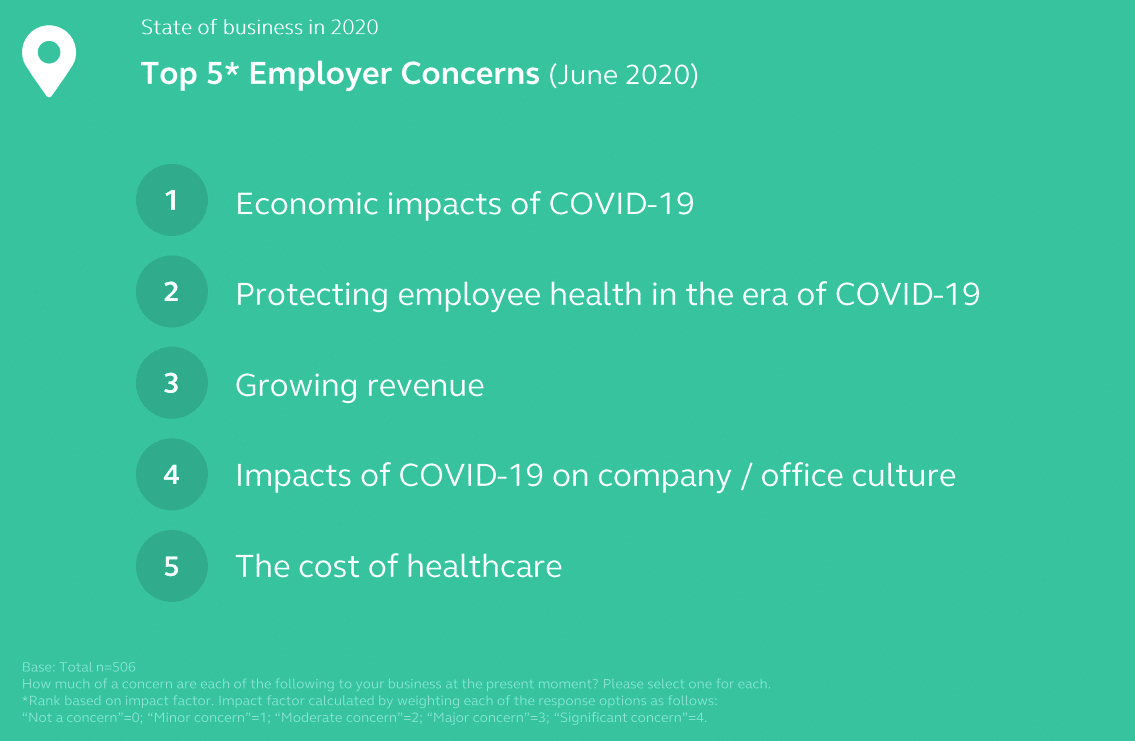

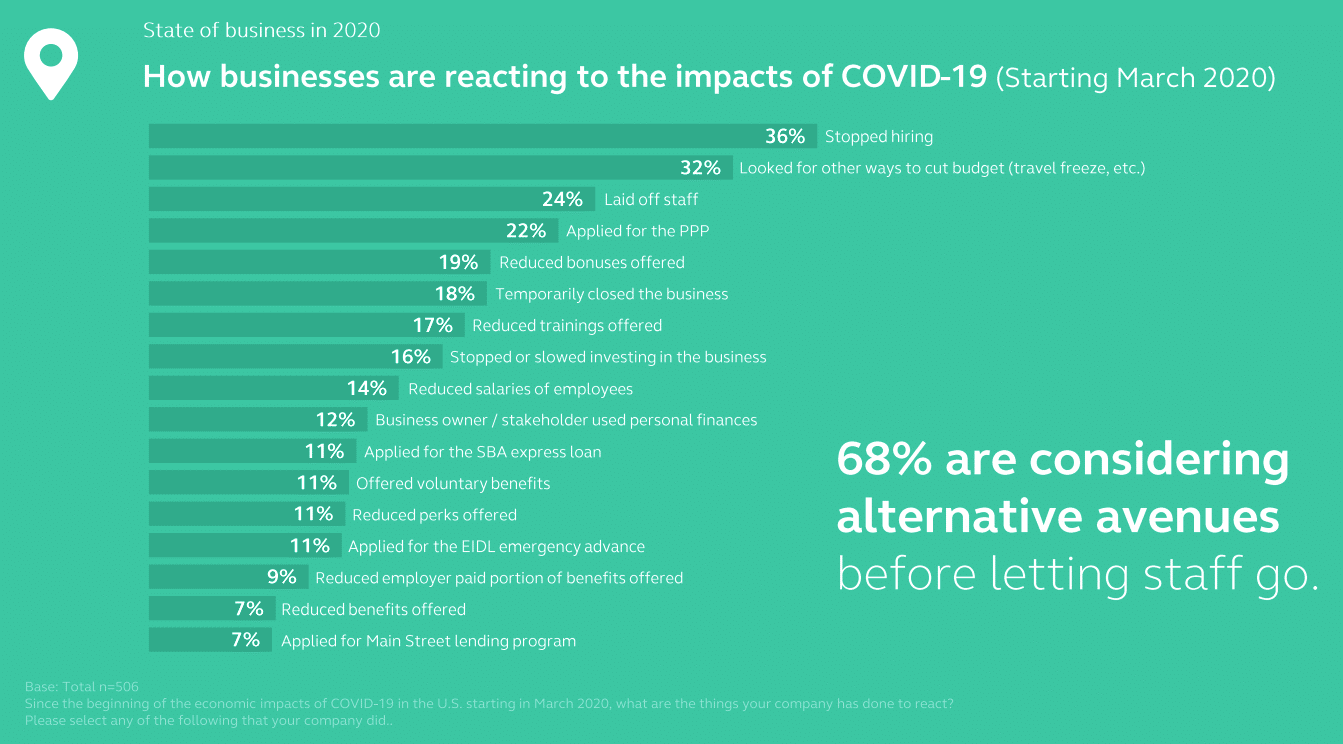

The economic and workforce implications of COVID-19, including employee health and workplace culture, continue to be a top concern of businesses at the midpoint of the year. Many continue to flex their operations and look for new sources of funding to manage through the near-term effects. A little more than half of respondents reported receiving government funding related to COVID-19.

Small businesses persevering through COVID-19

“We must adapt quicker to adverse economic changes,” another participant said.

In the survey, 87 percent of small businesses described their financial health as stable or growing compared to 93 percent reported by larger businesses. Cash-on-hand was cited as a key concern for these business leaders who had on average less than four months of cash available to run their operations as of June. Financial experts recommend having liquid assets (cash in bank accounts and very liquid investments) equal to three to eight months of operating expenses.

Despite reporting a significant economic impact as a result of the pandemic, fewer small businesses said they were considering filing for bankruptcy when compared with their larger counterparts. As of June, 89 percent of small businesses reported they would not consider filing for bankruptcy compared to 79 percent of larger businesses. Mark West, national vice president of business solutions at Principal, attributes this to the strong mindset of these owners on top of the common relationship between a small business owner’s personal and business finances and financial obligations.

“Most small business owners don’t consider a perceived failure such as bankruptcy an option. Their mindset is to do whatever it takes to keep their business and livelihood viable,” West said, in the release. “Also, for many of these owners, their business, personal assets, and personal liabilities may be commingled. Regardless of their business structure, it’s very common to sign personal guarantees which means that not paying a business bill doesn’t simply mean the business is responsible. The owner is responsible for the debt as well. Filing a business bankruptcy really means a personal bankruptcy for many small business owners.”

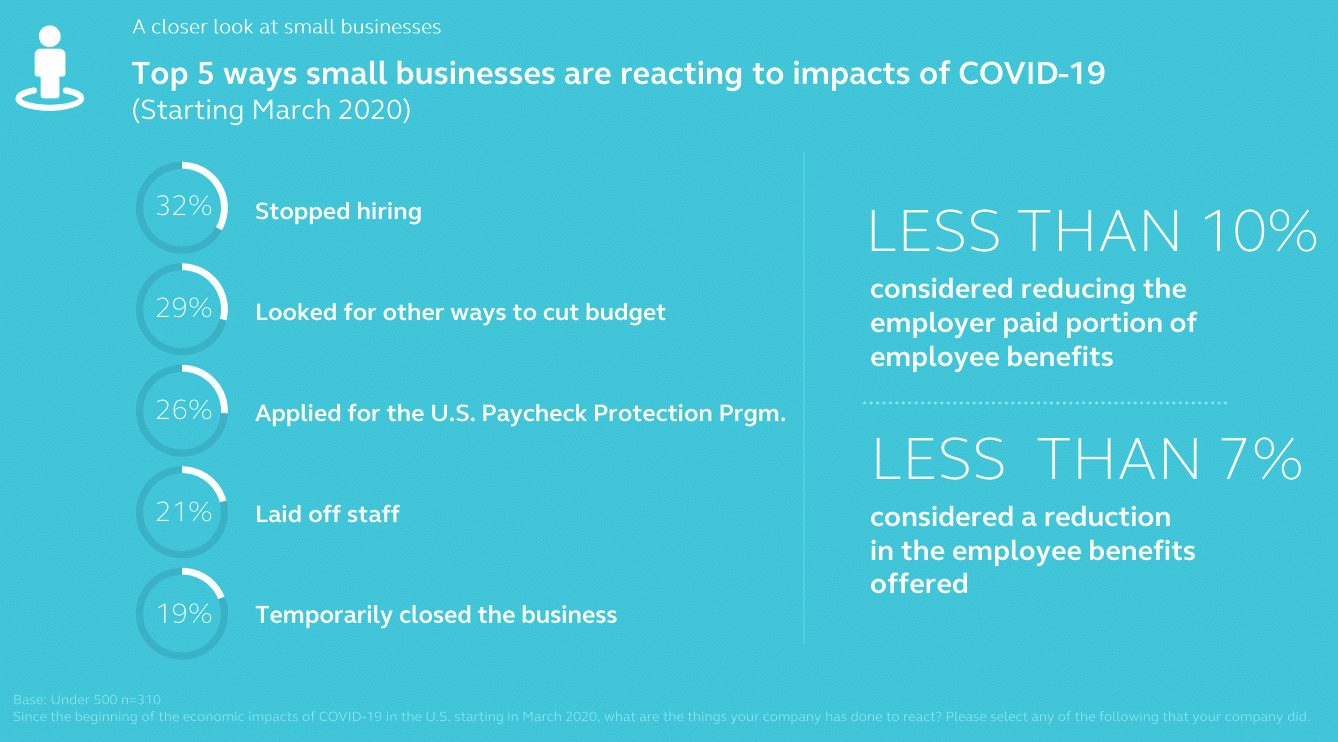

Small businesses are responding to the impacts of COVID-19 in different ways. The top three actions they’ve taken in response to the pandemic include a hiring freeze, alternative ways to cut their budget, and applying for federal assistance. Over 50 percent of small businesses were approved for some type of COVID-19 relief funding. While 77 percent are using the money for payroll, 58 percent are investing in employee benefits, including health care.

Technology and e-commerce were cited as key to improving their small businesses for the future. Forty-five percent of small businesses expect changes in technological innovation to have a positive effect on their business. They also anticipate that greater adoption of e-commerce tactics and tech tools will help retain clientele and attract new customers.

Looking ahead to reopening and recovery

“We must change and think outside the box,” another survey participant said.

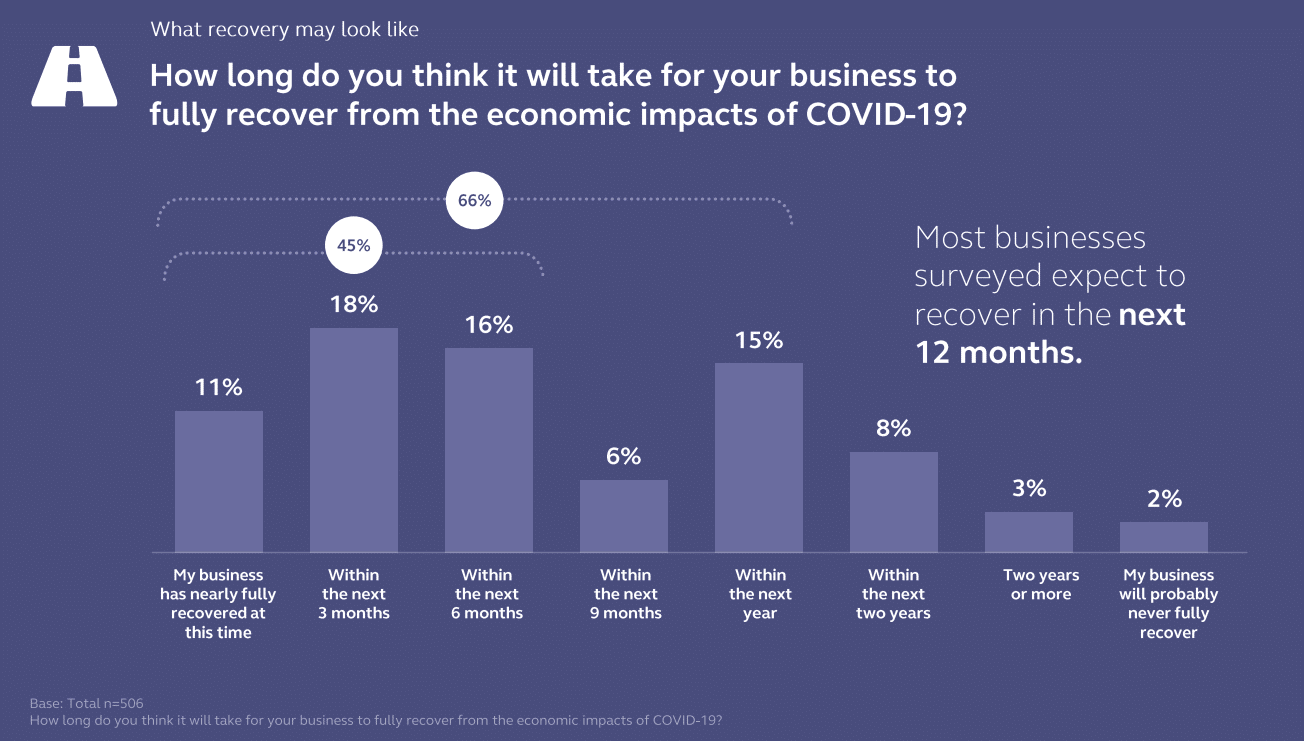

The future looks hopeful according to many survey respondents. As of June, 66 percent of businesses expect to recover in the next 12 months, and they’re evenly split on their overall economic outlook. While 39 percent are cautious about the economy, another 40 percent are optimistic.

Part of the road to recovery is reopening their businesses. Forty percent of business leaders say they will not reopen until “it feels safe for employees,” while 24 percent are waiting on a proven medication or vaccine for COVID-19 to become widely available.

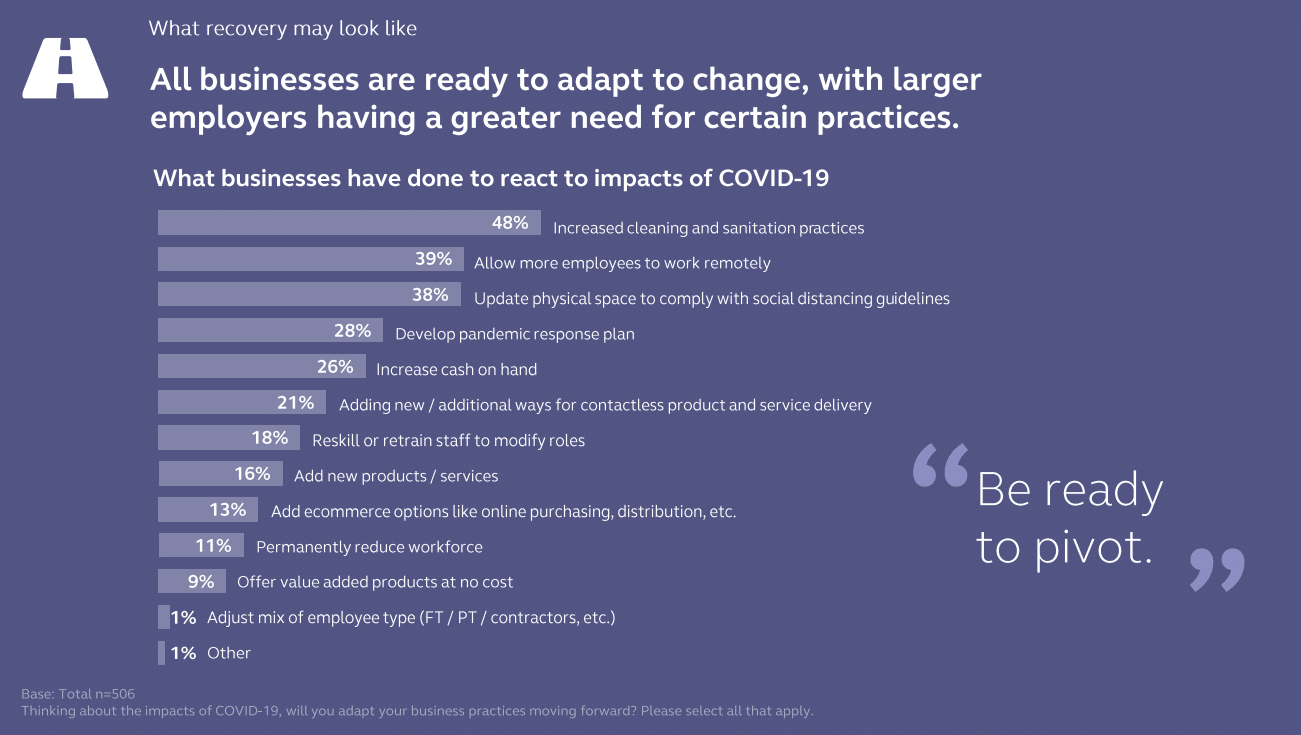

To keep operations going, businesses are adapting their practices, policies, and approaches. Top adaptations include increased sanitation practices, allowing more employees to work remotely, and increasing cash on hand. Despite the financial crunch, most businesses are not looking to cut back on employee benefits. Some are even reporting increasing offerings in employee mental health and well-being programs in addition to healthcare.