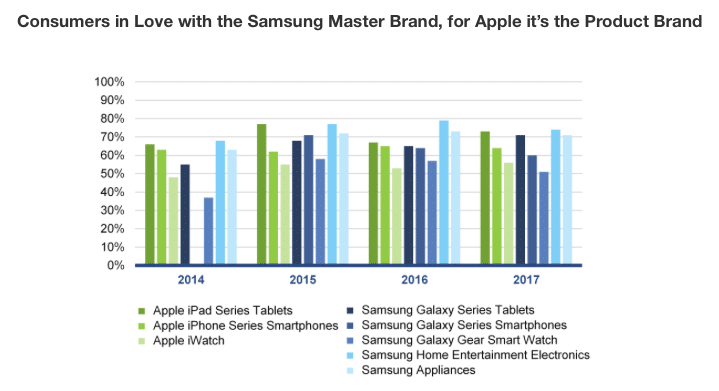

As we know, it doesn’t take much internal combustion to flatten your brand reputation in the smartphone market. According to The Harris Poll’s 29th annual EquiTrend Study, which measures brand health over time, Samsung’s smartphone brand equity declined in 2017 as a result of the Galaxy Note 7 recall—and while the decline is not unexpected, the brand equity impact for the Samsung master brand and other Samsung product brands is significant.

Yet despite its equity decline for the master brand’s various product brands, Samsung maintains a stronger emotional connection with consumers at the master brand level over Apple—Samsung holds a 74 emotional connection rating compared to Apple’s 70 rating, according to the research. Meanwhile, consumers’ love for Apple remains stronger at the product level.

“Looking at the Apple and Samsung master brands, when it comes to consumers’ love or emotional connection, Samsung clearly leads, benefiting from its presence throughout the home,” said Joan Sinopoli, vice president of brand solutions at The Harris Poll, in a news release. “But at the product level, when the brands compete head-to-head, Apple product brands frequently lead, especially this year. Samsung needs to leverage consumers’ positive connection with its master brand in order to compete more effectively with Apple at the product level.”

But the smoldering-smartphone damage has indeed been done: Brand equity ratings for Samsung Galaxy smartphone and Galaxy Gear smart watch have declined significantly since 2016, while Galaxy tablets continued a slide resulting in a significant loss in equity vs. 2015—and brand equity for the Samsung master brand dropped nearly three points. Brand equity tends to resist movement, so the brand equity gains and declines are significant.

“There is reason for Samsung to be concerned, as the Galaxy Note 7 crisis allowed Apple iPhone to strengthen its smartphone hold,” said Sinopoli. “The crisis also created challenges for the company’s entire mobile device franchise. Still, Samsung remains a strong brand. Home appliances and home entertainment are holding steady, and even with the decline, Samsung’s master brand is one of the strongest brands we measure.

“Brands can recover—Samsung need look no further than Volkswagen, Carnival, and Bank of America, all of which are bouncing back from earlier crises,” she added. “The Samsung Galaxy S8 has enjoyed excellent reviews, but it is critical that the new Note launch demonstrate that Samsung has left its problems behind.”

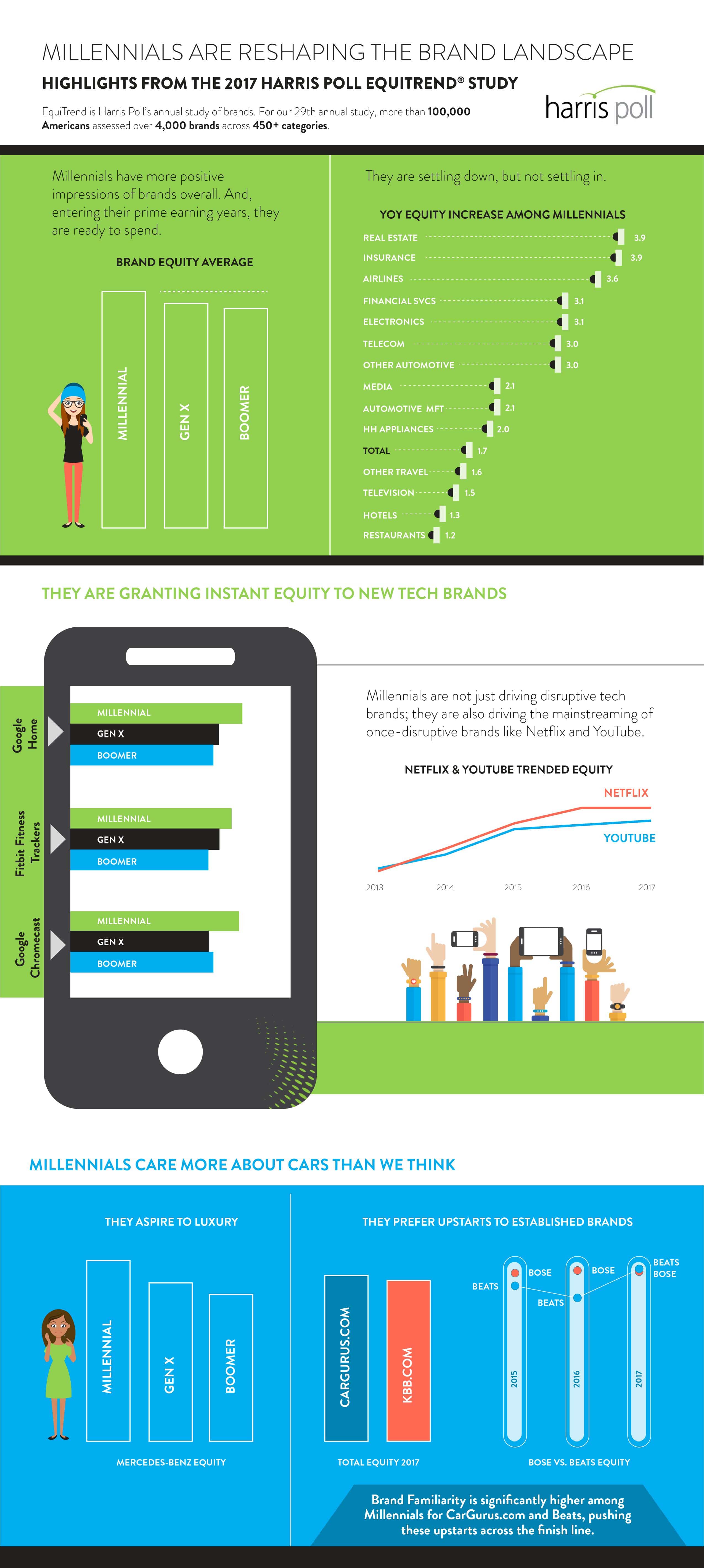

The Harris Poll’s EquiTrend Brand Equity Index is comprised of three factors—Familiarity, Quality and Purchase Consideration—that result in a brand equity rating, or a summary metric of a brand’s health, for each brand. The study reveals the strongest brands across the media, travel, financial, automotive, entertainment, retail, restaurant, technology, household and nonprofit industries based on consumer response.

Google triumphs over Amazon In smart home brand equity battle

Despite Amazon’s first-to-market status in the smart home race, Google Home bests Amazon Echo in brand equity ratings. This year’s study shows that Google Home, the Smart Home Device Brand of the Year, garners higher brand equity ratings (68 compared to Amazon Echo’s 62), and higher familiarity ratings (Google Home holds a familiarity rating of 61 percent, compared to Amazon Echo’s 46 percent), despite the fact that it had been in the market for less than one year. Meanwhile, consumers see Amazon Echo as the challenger or a brand “on the way up” in the smart home category.

“It’s unusual to see Amazon pressured for category leadership, but Google Home entered the market strong and didn’t quit,” said Sinopoli. “Even though it has been in the market a shorter time, Google Home easily surpassed Amazon Echo on familiarity ratings, carrying it to brand equity leadership. We expect the smart home brand battle between Amazon and Google to continue, as smart home products have built strong familiarity and brand equity over the past year, and are poised for continued growth.”

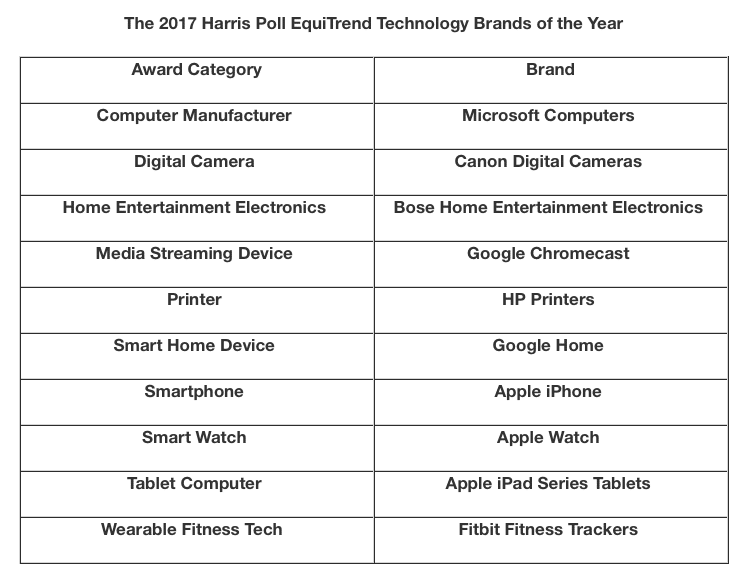

The brands’ competition continues in the smart watch category, with Apple Watch claiming the Smart Watch Brand of the Year title from Samsung, which held the top position in 2015 – 2016. Consumers are most familiar with the Apple Watch, followed by Samsung and Sony. The Apple Watch holds the highest quality ratings, while purchase consideration for Apple, Samsung and Sony smart watches are comparable.

Technology Brands of the Year

Brands ranking highest in equity receive the Harris Poll EquiTrend “Brand of the Year” award for their respective categories. This year, more than 100,000 U.S. consumers assessed more than 4,000 brands across more than 450 categories.

Additional technology findings include:

- While there is positive momentum in technology categories across age groups, media streaming momentum is stronger among millennials, while baby boomers are strong drivers of the smart home category momentum.

- Among media streaming device brands, Media Streaming Device Brand of the Year Google Chromecast is the most familiar to consumers, while Apple TV and Amazon Fire TV have improved quality perceptions.

- Wearable Fitness Tech Brand of the Year Fitbit Fitness Trackers is the most recognized fitness tracker, followed by Garmin Fitness Trackers.

- Momentum for wearable fitness trackers has slowed down since 2016, but nearly half (45 percent) of consumers agree that Fitbit is “on its way up.”

- While millennials show the strongest purchase consideration for smart watches, it is still the tech category they are least likely to purchase.

- Compared to other categories across industries, technology is among the top five categories for strongest equity ratings, and brand equity is increasing across several technology categories, large equity gains for wearable fitness tech, printers, media streaming devices and even the maturing smartphone category.

The full Harris Poll EquiTrend Brands of the Year list can be found here.

The 2017 Harris Poll EquiTrend Study is based on a sample of 102,617 U.S. consumers ages 15 and over surveyed online, in English, between December 30, 2016 and February 21, 2017. The survey took an average of 30 minutes to complete. The total number of brands rated was 4,052. Each respondent was asked to rate a total of 40 randomly selected brands.

Each brand received approximately 1,000 ratings. Data was weighted to be representative of the entire U.S. population of consumers ages 15 and over based on age by sex, education, race/ethnicity, region, income, and data from respondents ages 18 and over were also weighted for their propensity to be online. Respondents for this survey were selected from among those who have agreed to participate in Harris Poll surveys. Because the sample is based on those who agreed to participate in our panel, no estimates of theoretical sampling error can be calculated.