We’ve read aboutthe retail industry’s struggles with CX and customer service, but new industry rankings in brand intimacy show that retail is actually doing a good job of making an emotional connection with consumers. Retail ranked fourth out of the 15 industries studied in the latest Brand Intimacy 2019 Studyfrom marketing intimacy agency MBLM,which is the largest study of brands based on emotion.

Slipping one spot from its 2018 position, retail was ousted from the top three by the technology & telecommunications industry. However, overall the industry still ranked in the top third. Thereport also reveals that top intimate brands in the U.S. continued to significantly outperform the top brands in the Fortune 500 and S&P indices in both revenue and profit over the past 10 years.

Retail’s success in the study correlates to an increase in revenue for the industry; according to the National Retail Federation, preliminary estimates reveal that retail sales grew to $3.68 trillion in 2018, growing 4.6 percent over 2017.

Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love

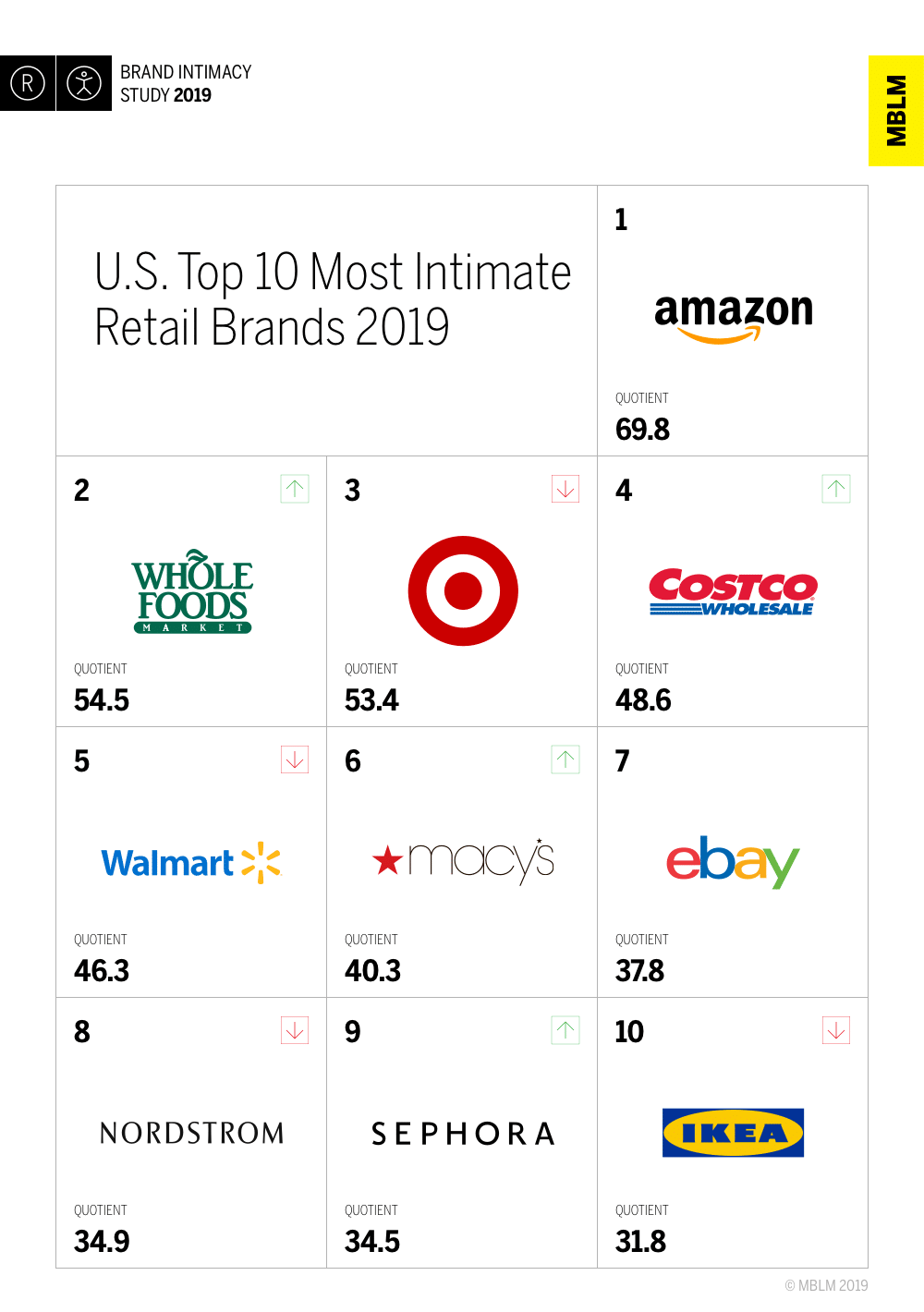

Amazon again led the retail industry this year, ranking first and second with its Whole Foods brand. The top 10 was rounded out by: Target, Costco, Walmart, Macy’s, eBay, Nordstrom, Sephora and Ikea.

“Amazon continued to dominate, not only topping the retail industry, but also ranking third in the overall study,” said Mario Natarelli, managing partner of MBLM, in a news release. “As the brand continues to grow, it has strengthened the emotional bonds it is forming with its consumers. Amazon has also been able to weather strong criticism about its business practices.”

Other notable retail industry findings include:

- The industry had an average Brand Intimacy Quotient of 41.8, which was well above the cross-industry average of 31.0

- Enhancement, the archetype associated with becoming better through use of the brand, was the most prominent in the category, and Amazon was the top retail brand for enhancement. This is the first year, fulfillment (about service and performance) was not the most prominent, suggesting a shift from service to digital engagement

- Sephora was the top brand for immediate emotional connection

- Amazon ranked #1 among women and users over 35, whereas men preferred Whole Foods and millennials favored Target

- Amazon was also the preferred brand among users with incomes under $100,000, while Whole Foods was the top brand for those with incomes over $100,000

- Costco and Macy’s improved their positions in the industry since last year, while Home Depot and Nordstrom feel in the rankings

MBLM also released a new article exploring the success of Amazon, entitled, “Dimensioning the Dominance of Amazon.” Since the inception of the annual Brand Intimacy Study, Amazon has consistently been a strong performer. A surprising factor in the brand’s performance is its ability to insulate itself from bad or negative feedback related to its aggressive business practices. Amazon also owns the #2 brand, Whole Foods, and averaging the two brands against the rest of the industry reveals the Amazon pair scored an average Brand Intimacy Quotient of 62.1, versus 37.8 for the rest of the category.

Looking at the consumer brands Amazon is nurturing reveals a powerful mix of sub-brands and services that surround the customer in a comprehensive and holistic way

The one area of weakness is how it relates to user demographics, performing better with older, female and lower-income consumers while being less compelling to millennials and Gen Z. However, the brand prevails at building intimate consumer relationships, and given its industry strength and ability to leverage resources, scale, data and content, MBLM believes it is only a matter of time before it will rank #1 in its annual study.

View retail industry findings here.

Listen to an on-demand webinar on the industry here.

During 2018, MBLM with Praxis Research Partners conducted an online quantitative survey among 6,200 consumers in the U.S. (3,000), Mexico (2,000), and the United Arab Emirates (1,200). Participants were respondents who were screened for age (18 to 64 years of age) and annual household income ($35,000 or more) in the U.S. and socioeconomic levels in Mexico and the UAE (A, B and C socioeconomic levels).