New research from software marketplace G2 reveals signs of accelerated technology adoption, shorter buying cycles, and a shift away from traditional resources. The firm’s newly released Software Buyer Behavior Survey indicates faster decision making, credit card transactions instead of negotiated contracts, and the near-ubiquitous use of peer review sites as the new normal in enterprise software purchasing, which increasingly resembles B2C buying behavior.

The study found that 55 percent of buyers need less than 3 months to make a decision on a software purchase of $20,000 or more. And 85 percent of all decisions are made in under six months.

“Companies are making software decisions more quickly than ever by taking their research and evaluation into their own hands,” said Amanda Malko, chief marketing officer of G2, in a news release. “Our data points to the growing consumerization of software buying, with the large majority of companies, including in enterprise, turning to trusted peer reviews to inform their decisions. Software companies who find ways to foster increased advocacy and word of mouth among their customer base will have an outsized advantage in the years ahead.”

Focusing on the new buying cycle is essential for success

The consumerization of decision-making in software sales is driving the speed and ease with which new tools can be adopted, leading more companies to adopt a product-led growth strategy. With buyers in the driver’s seat, the study demonstrates that companies who embrace product-led growth are likely to see more success—buyers are showing an appetite for strong engagement with those who utilize a similar product-focused approach. Other key findings include:

- With a shortened buying cycle, software buyers are in control: 67 percent of companies reported engaging with a vendor’s sales team only after they have already made a purchase decision.

- While buyers are doing independent research and are quick to purchase software, expectations around return on investment are high: The majority (80 percent) of respondents, representing organizations from small to enterprise scale, believe it’s important to receive a return on investment within six months, emphasizing the importance of product success.

With high expectations on ROI alongside consumer’s ability to more easily switch software, retention of existing customers is critical for businesses. That means more than ever, SaaS businesses need to turn their attention to keeping their customers and growing existing relationships.

Reliance on traditional research methods is decreasing, and customers are trusting their peers more

The survey findings show that buyers in 2021 are looking to their peers for guidance rather than relying on third-party reports from traditional analysts, with the majority (86 percent) of buyers using peer review sites when buying software. In addition, software sellers’ own websites were the most consulted source of information, however only 38 percent of respondents consider these sites to be the most trustworthy resource or rely on them solely when making purchasing decisions. In contrast, 60 percent reported feeling most confident about software buying after consulting online review sites.

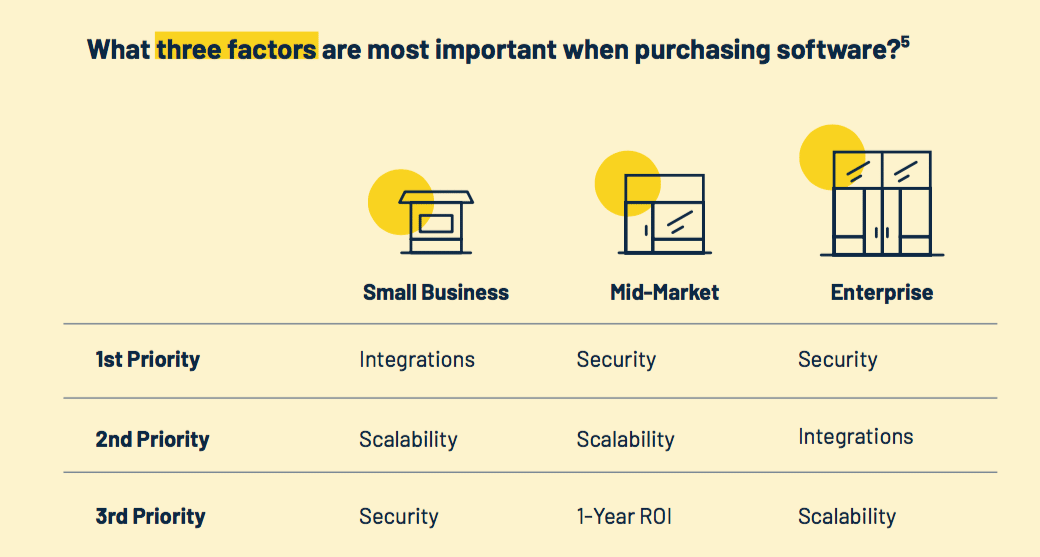

While trust in peer reviews emerged as a crucial element in the buying process, respondents also confirmed that security and trust in software remains their top priority. And, after a year of massive security breaches, it’s no surprise that security was the top consideration for buyers with an overwhelming majority (88 percent) reporting security as important or very important when making purchasing decisions.

- Almost 83 percent of buyers say their company requires a security or privacy assessment when purchasing software.

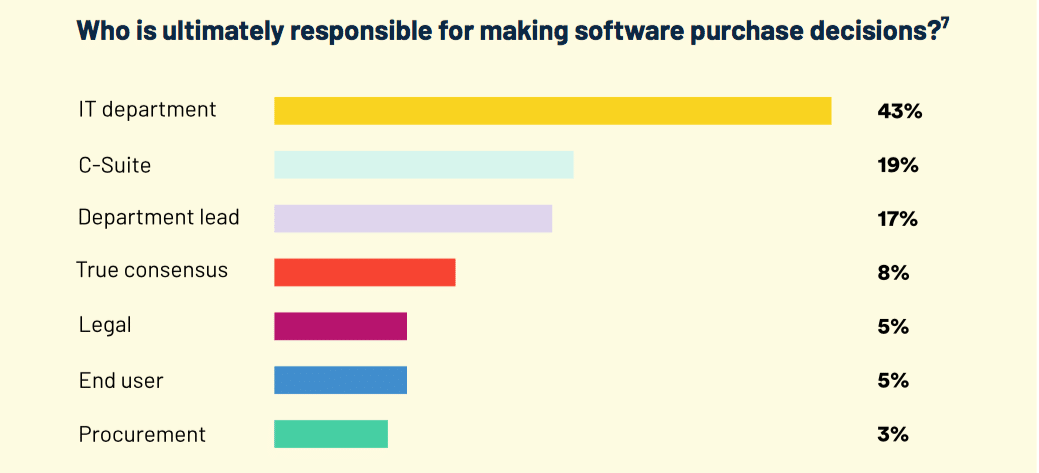

- Nearly 87 percent of these assessments are conducted by internal IT departments, expanding the buying committees beyond traditional stakeholders.

- Over half (53 percent) say security assessments are completed in under three months.

With increased software budgets, buyers are purchasing more—and more quickly

Following the challenges that COVID-19 presented to the market, over half (55 percent) of buyers reported they anticipate software spending will increase in 2022. To keep up, software sellers will need to adapt to a new buying cycle where there is less time to engage and influence purchasing decisions. This means rethinking the typical software selling strategy, which often relies on multiple touch points and consistent engagement with salespeople. Just as consumers expect to be able to try or purchase products without always relying on a salesperson, B2B buyers similarly often expect direct or on-demand buying experiences as they increase their software spend.

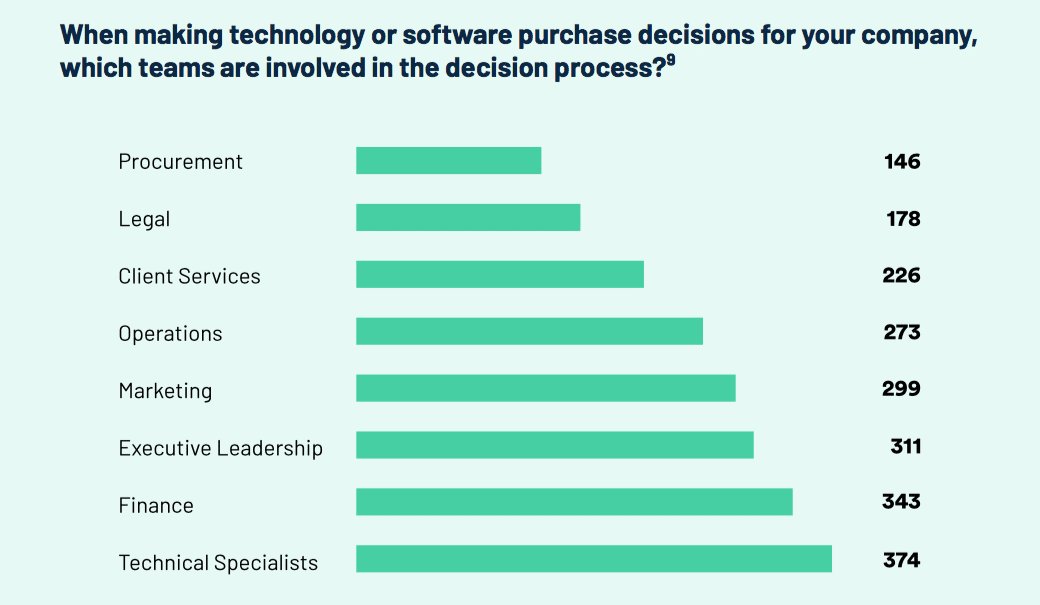

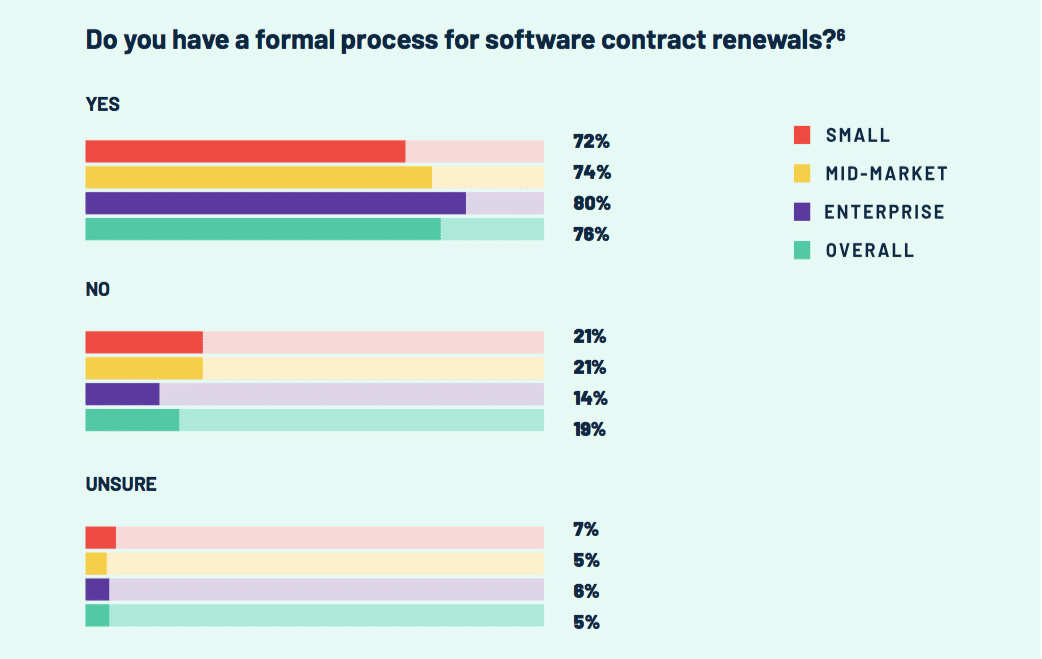

Plus, software companies need to consider the ever-changing roster of decision-makers and determinants that go into these purchases:

- The average number of people involved in a single purchase decision increased by 20 percent over the past year, and over a quarter of companies expect the number of people involved to increase in the next year.

- Almost three quarters (74 percent) of those surveyed with over one thousand employees said they will be buying five or more software tools this year.

- Buying is happening faster and becoming more frictionless with 53 percent of software purchases made on credit cards, including 48% of those for Enterprise.

“The findings of our Software Buying Report highlight the steep, upward trajectory of B2B software spending following a dip during the pandemic. But it also offers a caution to those software companies—they will need to work harder to reach customers who are increasingly drawn to a self-service model,” said Tom Pringle, vice president of market research at G2, in the release. “The buying cycle doesn’t end with a sale, and the decision-makers change throughout the process. With two-thirds of buyers engaging with sales people only after a decision has been made, sellers have to rethink their marketing strategies to reach the right people, at the right time, faster than ever.”

Download the full report here.

G2 fielded an online survey among 756 B2B decision-makers with responsibility for, or influence over, purchase decisions for departments, multiple departments, operating units, or entire businesses. Respondents had job titles ranging from individual contributor to manager, director, VP, or higher. The survey was fielded in June 2021.