As the retail industry continues its evolve-or-perish journey, Millennials, who are gaining a reputation for being “category killers” across various industries, are starting to wear their hearts on their sleeves—according to new research from retail tech group First Insight, this group is the most likely generation to “flex,” or display, brands to show a personal association with the brand, across every brand category in both the U.S. and UK.

The research points to the growing power of millennial shoppers, as their behavior contributes to the success and longevity of several retail models internationally more than other generations. According to the firm’s new study, Millennials also are currently the biggest spenders both in-store and online and are the most likely to add additional items to their carts than other generations.

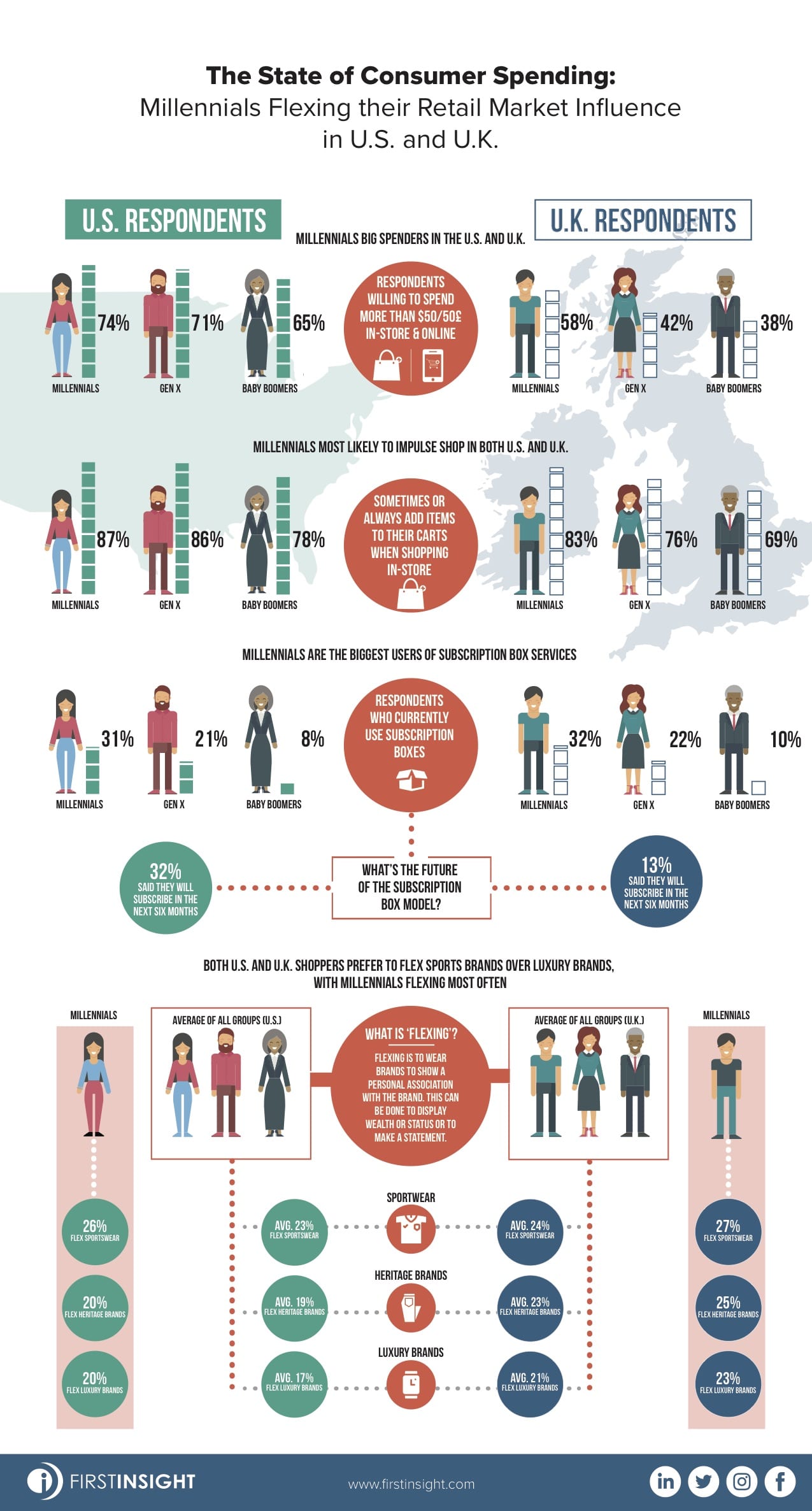

In addition, the study, The State of Consumer Spending: Millennials Flexing their Retail Market Influence in U.S. and UK, finds Millennials are currently using subscription box services the most, with more planning to subscribe in the coming year than other generations.

“Millennials continue to be the dominant force in retail both in the U.S. and the United Kingdom, as their shopping habits can be a deciding factor in what makes or breaks the success and longevity of retail models,” said Greg Petro, CEO of First Insight, in a news release. “Our study found that where Millennials shop, how they shop and when they wear the brands they love are in close alignment with how they define themselves. Retailers must be able to connect with this generation through the right shopping experiences and unique products if they want to capture the attention of this important generation of shoppers.”

Key findings include:

Millennials are big spenders in the U.S. and UK

According to the study, Millennials in both the U.S. (74 percent) as well as the UK (58 percent) were most likely to spend more than $50/50£ per visit in-store as well as online. This compares to 71 percent of Generation X and 65 percent of Baby Boomers in the U.S., and 42 percent of Generation X and 38 percent of Baby Boomers in the U.K.

Similarly, Millennials in the UK are also spending more than other generations online, as 50 percent of those surveyed spend more than 50£ per visit, compared to 47 percent of Generation X and 33 percent of Baby Boomers. In the U.S., Generation X shoppers are most likely to spend more than $50 when shopping online (59 percent), more than half of Millennials (54 percent) are spending as much, followed by Baby Boomers (49 percent).

Millennials are most likely to impulse shop in both U.S. and UK

In both the U.S. and UK, by generation, Millennials have the highest added-to-cart percentage rates in-store and online. In the U.S., 87 percent of Millennials said they sometimes or always add items to their carts they weren’t planning to buy when shopping in-store. This compares to 86 percent and 78 percent of Generation X and Baby Boomer respondents, respectively. UK respondents mirrored these responses closely, as 83 percent of Millennials said the same, followed by 76 percent of Generation X and 69 percent of Baby Boomers.

When shopping online, UK Millennials are more likely to sometimes or always add items to their carts (83 percent) compared to the U.S. (78 percent). However, Millennials both in the U.S. and UK far outpace other generations in their respective country. In the UK, 69 percent of Generation X and 52 percent of Baby Boomers surveyed said they add items to their cart when shopping online. In the U.S., 74 percent of Generation X and 53 percent of Baby Boomers said the same.

Both U.S. and UK shoppers prefer to flex sports brands over luxury brands, with Millennials flexing most often

The study also examined which types of brands are being “flexed” most. Flexing is to wear or display brands to show a personal association with the brand. This can be done to display wealth or status to make a statement. While the assumption may be that most consumers prefer to personally associate with luxury brands, the study found that sports brands are actually the most popular in both the U.S. and UK, with Millennials the most likely to flex all brands across every category.

In both U.S. and UK, an average of 23 percent and 24 percent of study respondents overall said they are flexing sports brands, versus 19 percent in the U.S. and 23 percent in the UK saying the same for heritage brands. By comparison, an average of only 17 percent of U.S. respondents and 21 percent of UK respondents flex luxury brands.

The generation most likely to flex luxury brands is Millennials in both the U.S. (19 percent) and the UK (22 percent), they were significantly more likely to flex sports brands (26 percent in the US and 27 percent in the UK). Further, heritage brands were also more popular with Millennials, as 21 percent of Millennials in the U.S. and 25 percent of Millennials in the UK reported flexing these brands.

Millennials are the biggest users of subscription box services in U.S., and UK, but far fewer respondents overall plan to subscribe in UK

Data around usage of subscription box services is similar when comparing the U.S. to the UK, driven primarily by Millennial adoption. Twenty-five percent of respondents in the U.S. and 23 percent of the respondents in the UK currently subscribe to subscription boxes. This is driven primarily by Millennials in both countries, as 31 percent of Millennials currently subscribe to subscription boxes in the U.S. versus 21 percent and 8 percent of Generation X and Baby Boomers, respectively. In the UK, 32 percent of Millennials versus 22 percent of Generation X and 10 percent of Baby Boomers are currently subscribers.

However, when considering longevity of the subscription box model, data reflects a significant difference between UK and U.S. shoppers. While in the U.S., overall 32 percent of study participants intend to subscribe in the next six months, only 13 percent of UK respondents said the same. When looking at generational breakdowns, 38 percent of Millennials, 28 percent of Generation X and 22 percent of Baby Boomers in the U.S. plan to subscribe in the next six months. This is significantly more than UK respondents, where only 18 percent of Millennials, 9 percent of Generation X and 8 percent of Baby Boomers plan to subscribe.

Download the full report here.

First Insight’s findings are based on the results of a U.S. consumer study of a targeted sample of more than 1,000 respondents fielded in February 2019, and a similar study of 565 respondents in the U.K. fielded in April 2019. The study was completed through proprietary sample sources among panels who participate in online surveys.