Consumers aren’t the only deep-pocketed group that have begun using a business or brand’s dedication to corporate responsibility as a purchasing metric—a whopping ninety-eight percent of institutional investors now say a company with strong environmental, social and governance (ESG) initiatives makes for a more attractive investment, according to a new report, Is Your ESG Report Getting Noticed?, developed by Burson-Marsteller and research firm PSB.

The survey findings revealed important insights into how investors consume ESG data and how companies can better tailor their ESG reports for this critical audience. “The responsible investment movement is here to stay,” said Tim Mohin, chief executive of the Global Reporting Initiative (GRI), in a news release. “Savvy investors realize that aligning their capital with sustainable business practice is a smart, long-term strategy.”

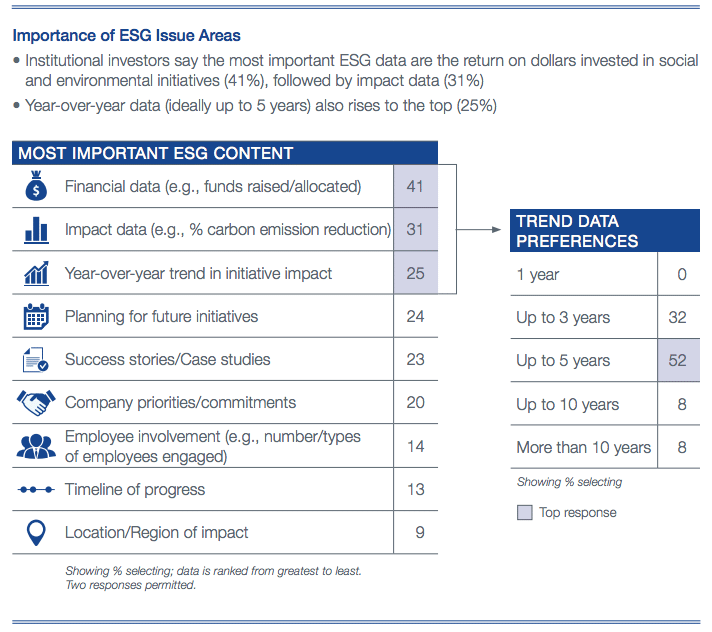

Building on their interest in ESG initiatives, institutional investors say the most important ESG data are the return on dollars invested in social and environmental initiatives (41 percent). This is followed closely by impact data, such as quantified reduction in carbon emissions (41 and 31 percent, respectively).

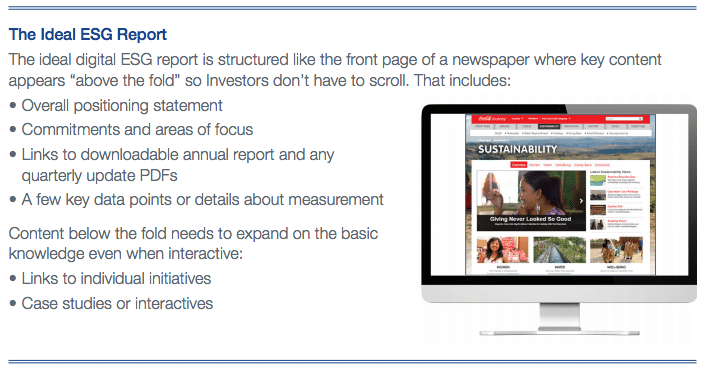

When it comes to today’s evolving digital world, institutional investors are divided on the preferred format of an ESG report. The survey found that roughly half see digital ESG reports as sufficient, while the other half looks for a more in-depth PDF report that can be saved or printed. While investors believe digital reports make it easier to find data (37 percent) and share content (36 percent), almost all (95 percent) say it is very important that a report be downloadable.

“The financial impacts of a company’s sustainability policies and initiatives are no longer in question,” said Jane Madden, managing director of U.S. Corporate Responsibility at Burson-Marsteller, in the release. “This study shows the importance of content, format and credibility to ESG reporting. The findings suggest institutional investors are keenly interested in ESG performance. Companies need to communicate ESG performance with data, transparency and links to business impacts.”

Additional findings include:

- Roughly six in 10 investors say ESG reports should provide comprehensive and detailed information, while 37 percent prefer they be short, concise and to-the-point.

- Nearly two-thirds of investors say it is very important for digital ESG reports to be easily shareable, downloadable and printable. Another half (52 percent) say it is very important that they also be mobile friendly.

The white paper revealed results of a survey conducted among institutional investors at banks, insurance companies and hedge/mutual funds that have investments of at least 10,000 shares on the stock exchange. Respondents have worked at their current company for at least one year. PSB conducted the research on behalf of Burson-Marsteller from December 2016 to January 2017.