As the pandemic shifts again with new threats to business and consumer industries, customer and employee experience firm Medallia has released The Future of Retail Consumer Behavior, a new report examining the changes in retail consumer behavior over the last year, including close analysis of specific industry sectors like grocery, beauty and sporting goods.

“Retail consumer behavior changed drastically over the course of the past year, but as consumers and businesses begin to define a new normal, we wanted to understand what behavior changes will be permanent and what trends may already be fading,” said Andrew Custage, head of analytics for Sense360 By Medallia, in a news release.

To track and understand consumer behavior, Sense360 By Medallia combined data from three sources: foot traffic data from smartphone geolocation of more than 2 million opted-in consumers, spend data from more than 6 million consumers, and psychographic survey data. Combining multiple datasets yields a more holistic view of the customer journey, and a more accurate way to answer strategic insights questions for retailers.

Drawing on this industry leading pool of data, the report examines:

- Consumer spending trends and surveys from 15 months of daily research

- How consumer behavior has changed—and which habits are here to stay

- How different retail sectors have been affected, and specific strategies for retaining customer loyalty in the grocery, sporting goods, and beauty sectors.

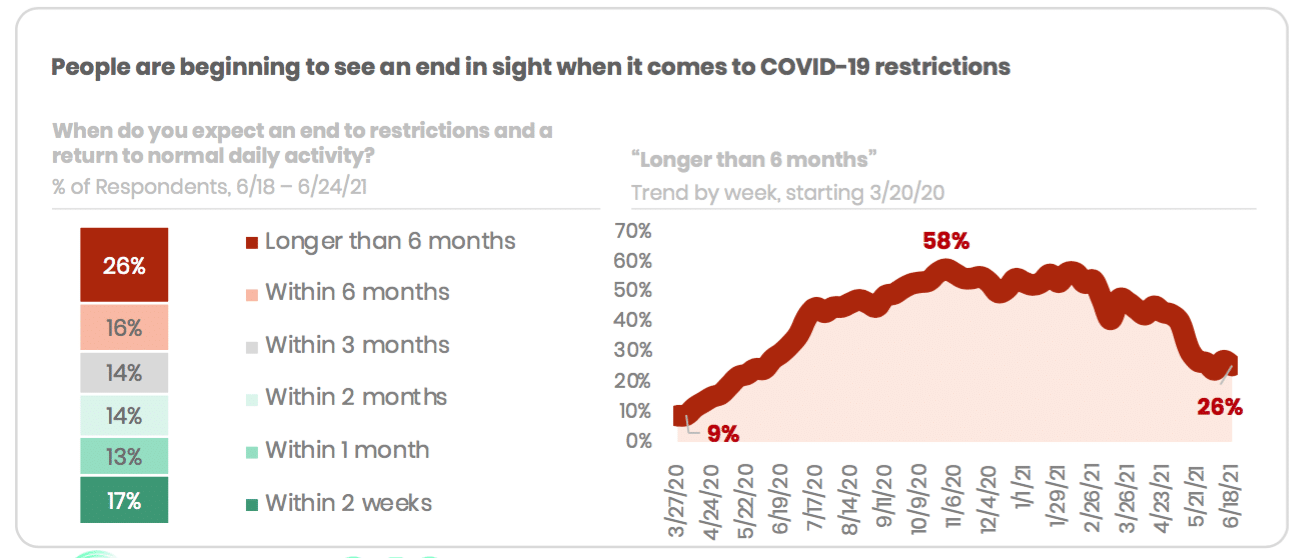

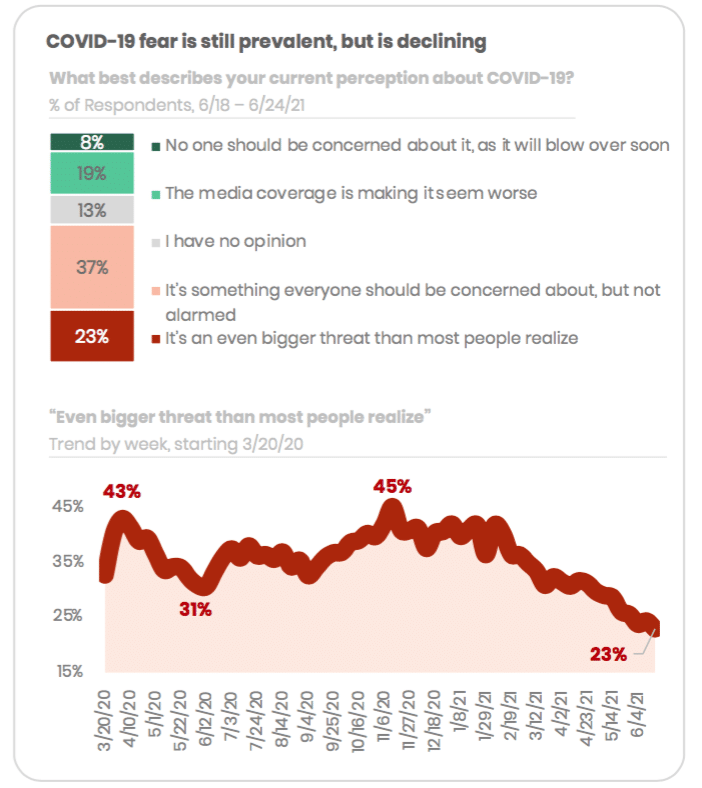

Despite recent concerns over the Delta variant, overall fear levels toward COVID-19 have subsided compared to a year ago. However, surveys show that there will likely always be a group of people whose fears are here to stay. Consequently, their behaviors and shopper journey have shifted—in some cases, likely permanently. The shift to online shopping continues, despite the pandemic having slowed down.

Sector breakdown:

-

Grocery

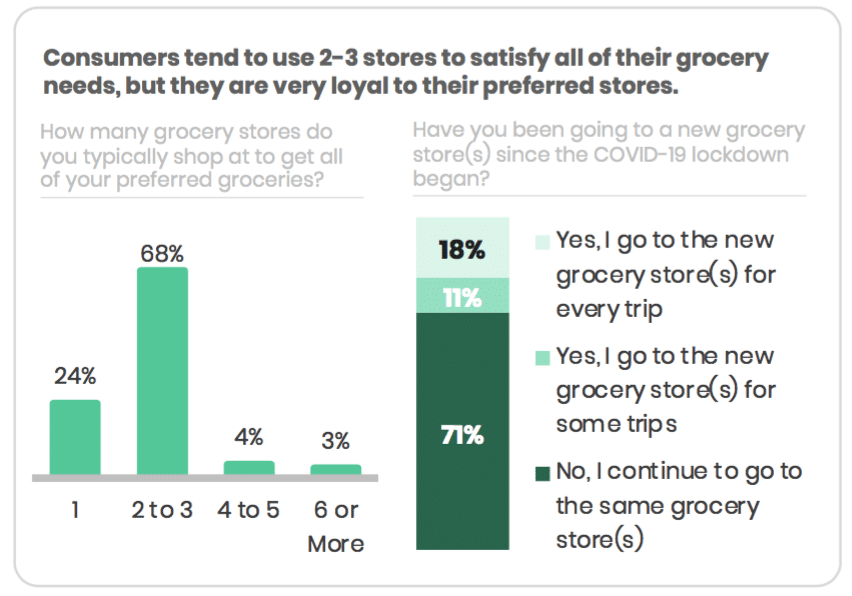

One of the biggest pandemic-induced habits is the channel shift to grocery delivery and curbside pickup. Although it’s now safe to shop in-store, consumers have embraced off-premise behavior—and many of them won’t go back.

-

Sporting Goods

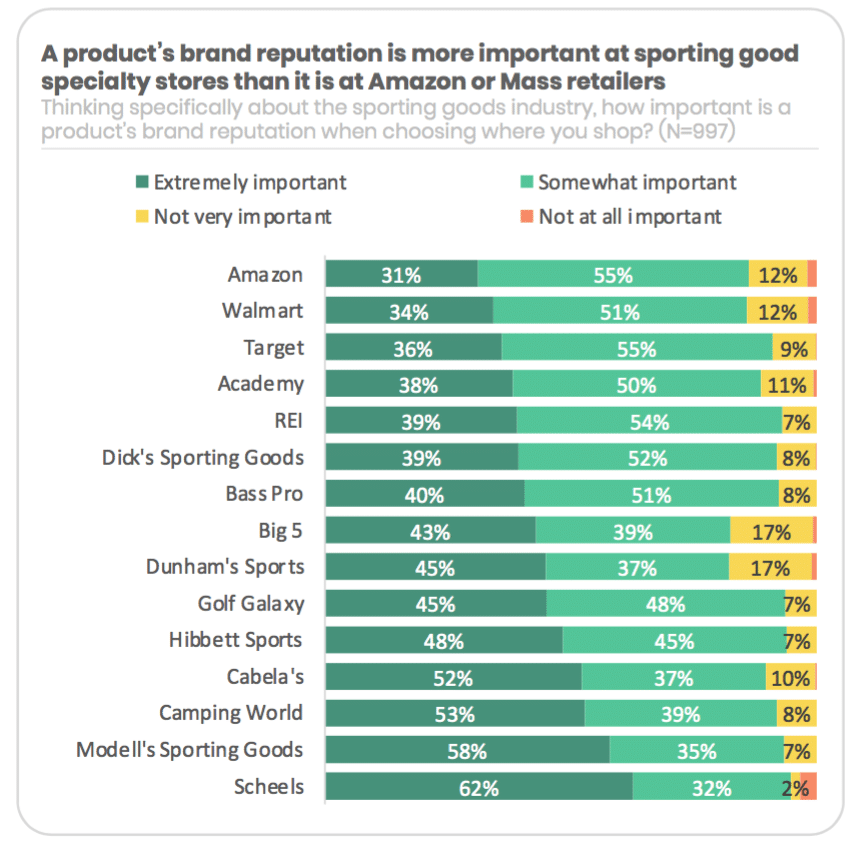

This retail category shows not all pandemic habits are here to stay. An uptick in demand for sporting goods during early lockdown periods is tapering off as consumers look to move beyond at-home exercise. The current market is seeing a split with mass retailers plus Amazon competing on price, and specialty retailers competing on product selection and quality. Specialty retailers will need to find more ways to reach and retain the customer to compete with Amazon’s growth.

-

Beauty

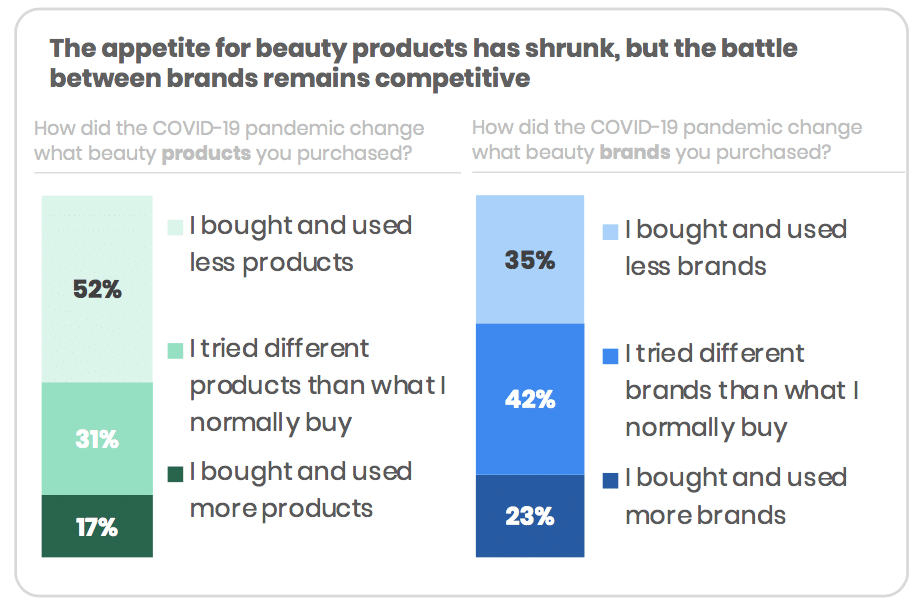

The beauty retail space has become an even more competitive, zero-sum game. The pandemic tightened the purse strings of consumers, and although their spending on beauty is recovering compared to last year, they aren’t planning to increase purchases much more. They also plan to try different products and different brands while simultaneously shifting their spend to mass and department stores. Beauty specialty retailers and DTC brands are in an increasingly difficult battle for consumer loyalty.

“Perhaps the clearest insight from the report is that while consumer behavior was initially forced to change by the pandemic, certain habits continue to stick even as restrictions loosen—creating a sustained adoption of digital platforms,” continued Custage. “In order to understand the volatile world we now live in, it’s critical for retailers to use holistic research to understand their customers and the competitive landscape.”