Under the mattress, in your phone or through your fingerprint? How close are we to adopting a cashless culture? New research from Origin, the independent research arm of creative marketing firm Hill Holliday, finds consumers grappling with the future of cash, cards, mobile, and everything in between. The findings represent significant insights into the grocery, retail and restaurant categories in particular.

The study, Cashless Culture, the Marketer’s Guide to the Emerging Cashless Consumer, examines current preferences, habits, and attitudes among U.S. consumers about going cashless and cardless, including adoption rates and barriers for mobile and app-based payments, and the attitudes that still remain for both consumers and businesses in their attachment to cash.

Not surprisingly, younger consumers are leading the way in mobile wallet and app-based payments such as Apple Pay and Venmo, but they remain uncommitted. And businesses are pushing back on accepting mobile payments due to costs, tech adoption and perceived lack of interest among consumers.

As part of the research, Hill Holliday also conducted a deprivation study with 10 adults, who agreed to “go cashless” for a week and record their experiences. The results were surprising, shining light on the social pressure aspect of mobile and app-based payments: “I asked if the restaurant accepted mobile payments and the waitress looked at me disapprovingly,” said one participant. Spoiler alert: every participant cheated.

Among the compelling data points:

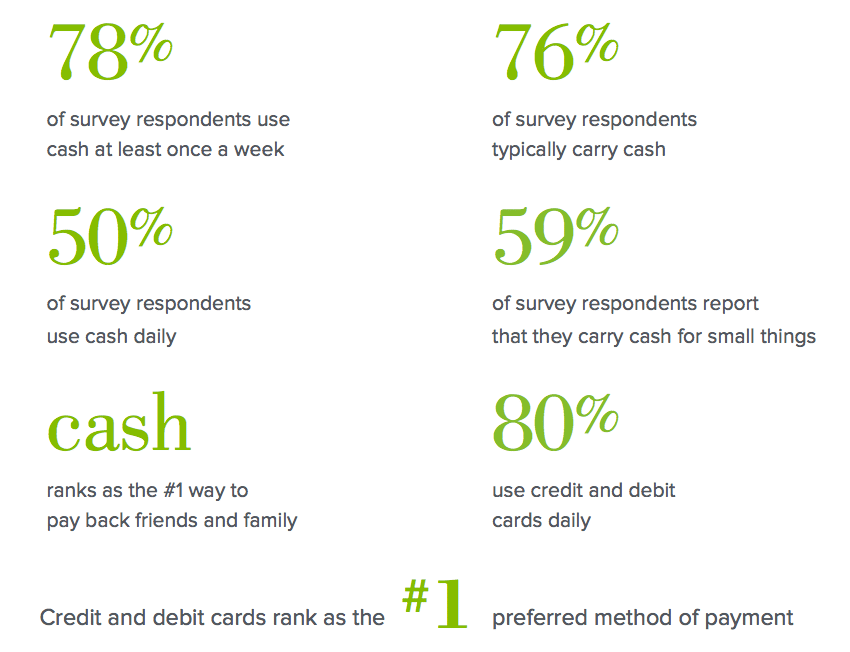

Cash and cards are far from dead

- 76 percent still carry cash daily

- 55 percent hate the idea of life without cash

We’re still new at mobile payments, but younger consumers are leading the way

- 58 percent of those using mobile payments have only started in the past year

- 45 percent of those over 40 have never used mobile payments; while 22 percent of those under 40 use it daily

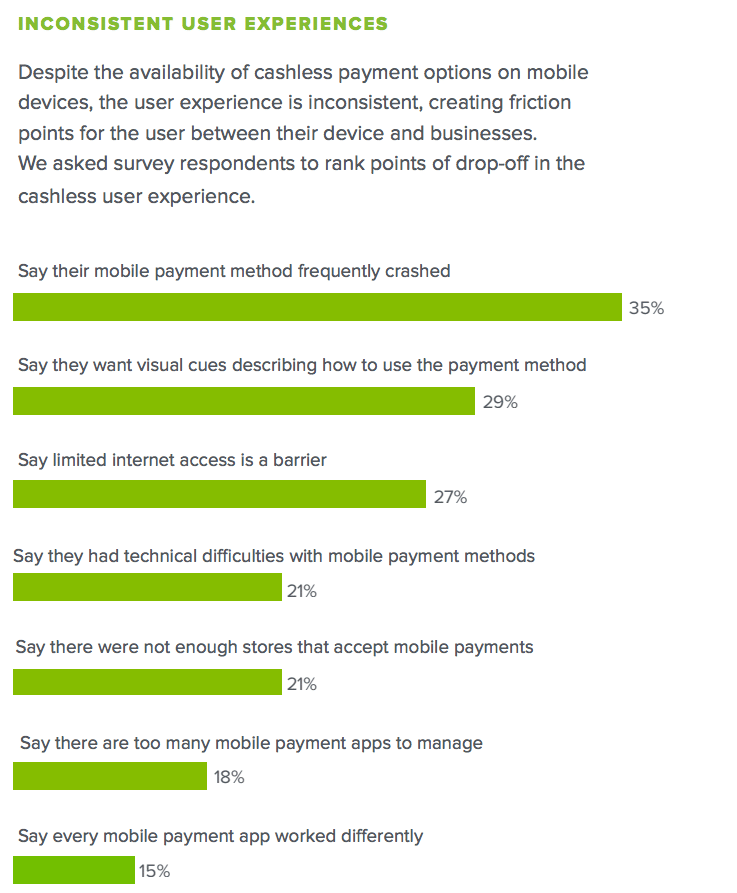

Significant barriers to going cashless remain

- 45 percent say there is no reason to use mobile payments

- 63 percent say clear and consistent visual cues around mobile payment options are needed at P.O.P.

“We were really surprised how attached to cash the average consumer still is,” said Katherine Schilling, strategy director for Hill Holliday and a key driver of the study, in a news release. “The user experience isn’t quite there yet for mobile and app-based payments, and many businesses still struggle with the transaction technology. Another surprise: social pressures surrounding cashless payment were a recurring theme. Brands still have a lot to learn about which consumers will go cashless, and how they can help them get there.”

Download the full report here.

The Cashless Culture study is based on the views of over 1,000 diverse, qualified smartphone users, 18 years of age and older, varying in age, sex, and geographic location.