CEOs, chief digital officers and other senior executives are not yet aligned on business investment strategies for digital initiatives like cloud computing and artificial intelligence, and are struggling to measure return on digital investment (RODI), according to new research from Ernst & Young.

Even though these tools are now table stakes in today’s business investment landscape, scaling these digital initiatives—and maximizing their return—remains a challenge for business leaders, finds the newly released Digital Investment Index, conducted by EY-Parthenon, the strategy consulting teams of the EY organization.

“Budget constraints in the pandemic economy and transformation fatigue across organizations threaten to turn digital promises into mere buzzwords—unless organizations can prove the value of their investments to the bottom line,” said Peter Ulrich, EY-Parthenon principal, digital strategy and transactions at Ernst & Young, in a news release. “EY data shows that executives have still more work ahead to bolster their digital investments and to realize results. A strategy which coherently outlines both growth and savings across an organization is necessary to carving a winning path forward.”

Digital leaders focused on boosting resilience and future-proofing the enterprise

Very few business leaders have been able to successfully steer their digital investment strategy toward a differentiating upside—just 9 percent of respondents claimed to do so. Among these digital leaders, though, there were a handful of common themes that helped them achieve stronger returns; in fact, leaders reported roughly 40 percent more revenue growth than non-leaders.

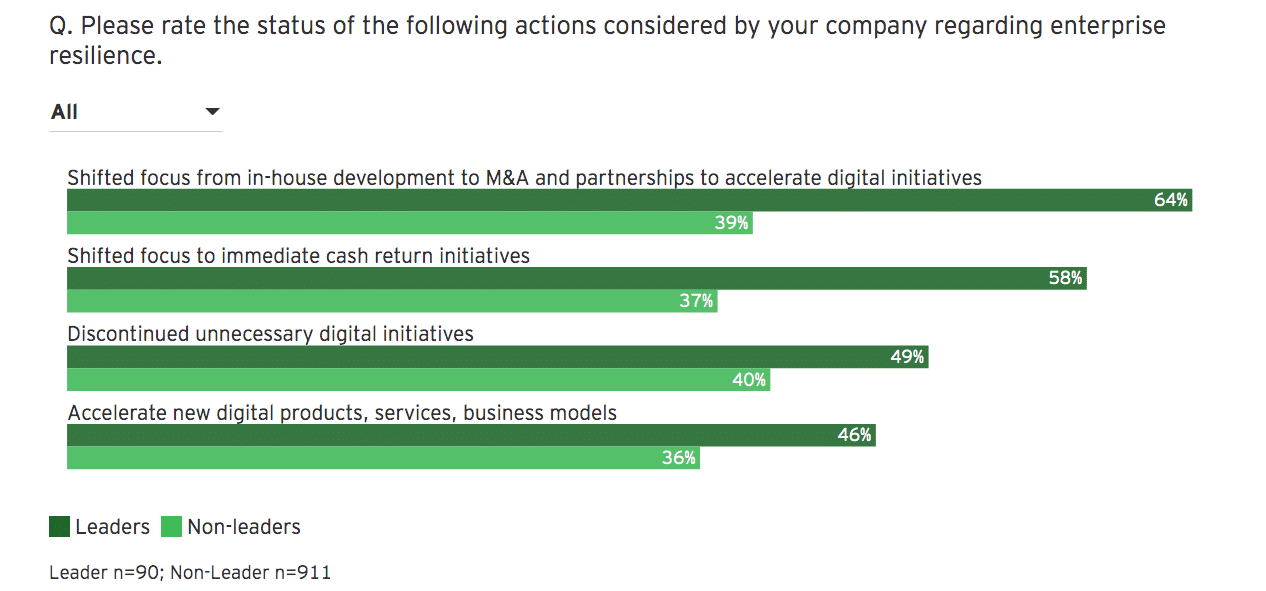

Digital leaders are accelerating new digital products, services and business models, and have a clearly defined strategy to do so (48 percent vs. 36 percent of others).

Leaders are futureproofing the enterprise:

Their strategies commonly included a shift in focus from in-house development to mergers and acquisitions (M&A) and partnership (64 percent vs. 39 percent of others) and a reprioritization of digital initiatives to those with immediate cash returns, while discontinuing unnecessary initiatives (58 percent vs. 37 percent of others). That technology mix is more likely than others to include investments in the internet of things (IoT), cloud computing and advanced cyber defense—showing that leaders are creating a strong foundation (through cloud and cybersecurity) to rapidly accelerate emerging technology solutions, such as AI and IoT.

Realizing benefits from technology

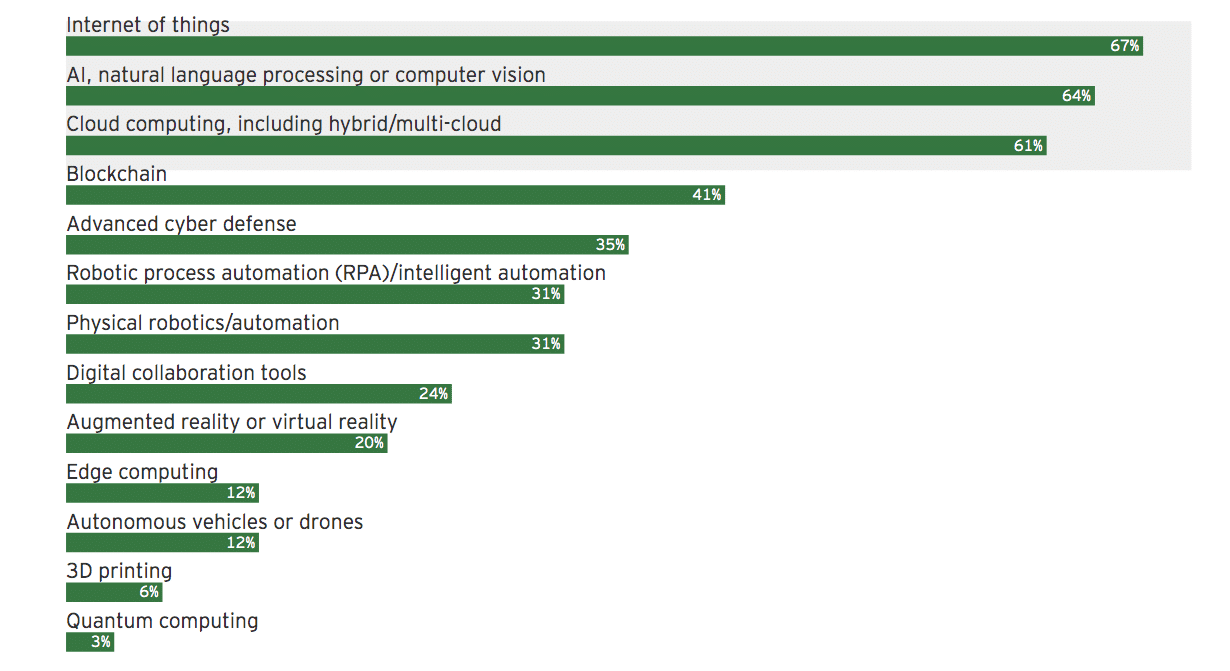

Nearly two-thirds (62 percent) of executives agree that organizations must radically transform their operations over the next two years. To do that, they are starting to turn to emerging technologies. Among the most common investments of the next two years will be IoT, AI and cloud computing (67 percent, 64 percent and 61 percent, respectively). And while these capabilities will become prevalent across sectors and strategies, the impact of these investments to end clients and the bottom line might prove slow. Thus far, only 7 percent of respondents report achieving the full benefits of AI and IoT.

In which emerging technologies has your company focused its investment over the next two years?

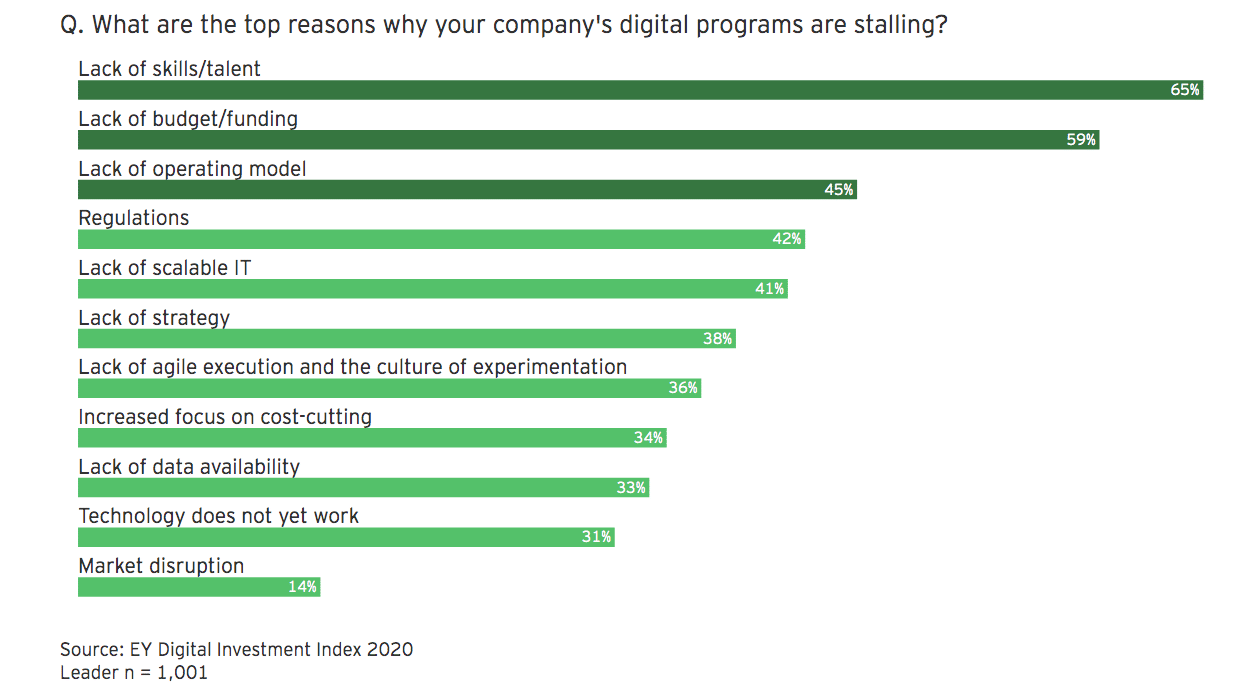

“Executives need to grasp what stands in the way of their benefiting from transformative technologies, and that might not always be a simple analysis,” said Ulrich. “A majority of survey participants cited a lack of requisite skills or talent, a lack of budget, or poor-quality data and data analytics functions, suggesting that many companies are grappling with some mix of the three. Oftentimes, many companies think too early about the technology rather than establishing a sound digital strategy. Instead, businesses should focus on the value they want to bring to the business, and then find the technology to match.”

Aligning on organic vs. inorganic investment strategy

The Index shows that, while many executives understand which technologies they need to succeed in a digital future, many are uncertain about which investment vehicles are needed to acquire and implement these technologies.

M&A, corporate venture capital and partnership investments stand out as successes. Of the executives who pursued digital technologies via M&A, 52 percent say that the approach exceeded expectations, and 45 percent report similarly for digital partnerships.

However, the risk of not realizing for benefits from a startup deal is real. Of the executives who say that their digital M&A investments fell short of expectations, 64 percent say that misaligned sources of value were the primary concern.

Skills, budget and operating model challenges hamstring digital programs:

“Executives need to align on their mix of ‘build, partner, buy, and corporate venture,’” said Sonal Bhatia, Americas EY-Parthenon transaction strategy & execution leader, in the release. “These are the fundamental building blocks of digital strategy execution, and their rewards should be balanced carefully against the capital and timing needed, and risk appetite, to make each a reality. Thriving tomorrow will be contingent on intelligently integrating digital investments with broader strategies.”

Looking externally to obtain skills and overcome barriers to scale

Even those companies that maintain a clearly defined digital strategy encounter barriers to achieving their goals. A lack of skills (65 percent), budget (59 percent) and operating model (45 percent) are the top barriers to challenges for survey respondents. Interestingly, a mere 14 percent cited market disruption as a problem.

“As with any winning strategy, a flexible operating model, well-skilled employees and a culture of innovation are critical to realizing full potential,” said Ulrich.

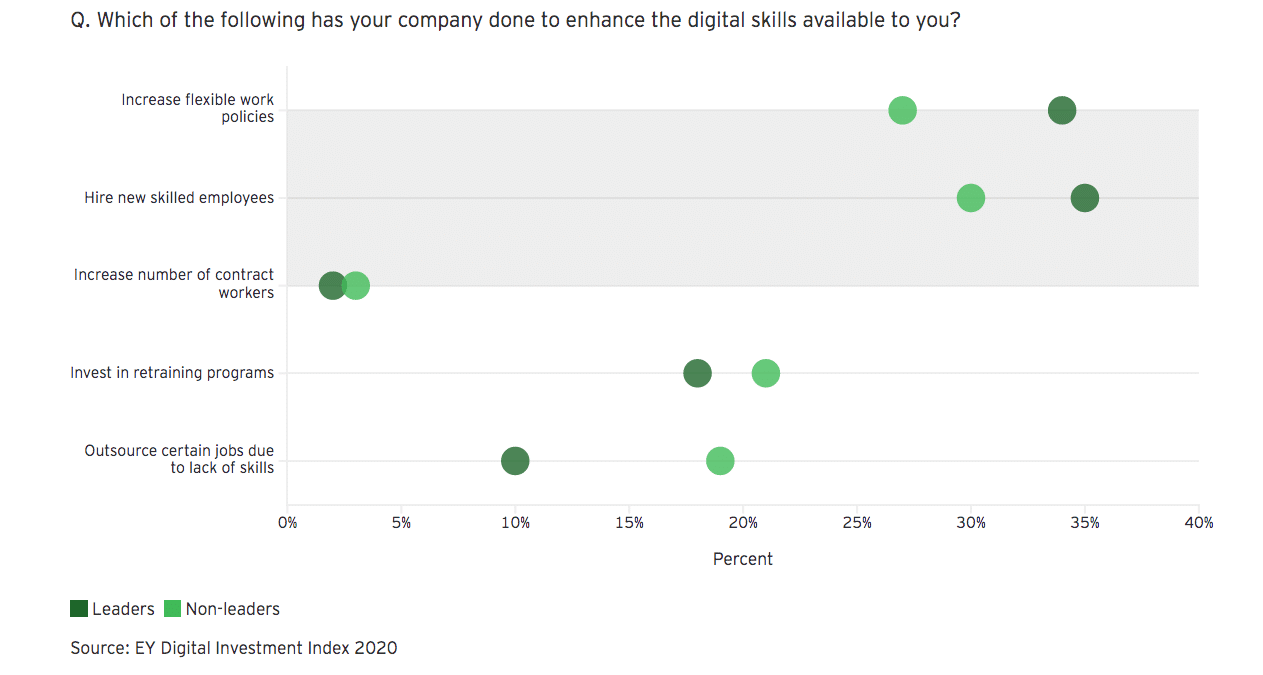

Leaders in the digital transformation space—those respondents who are experiencing above-average returns on their digital investment—are more likely than non-leaders to hire new employees (34 percent vs. 27 percent) and support flexible work policies (35 percent vs. 30 percent). Conversely, leaders are less likely than non-leaders to invest in retraining programs (18 percent vs. 21 percent) and outsource capabilities (10 percent vs. 19 percent).

Leaders look outside the company to obtain skills:

“Removing barriers to implementation is not a straightforward process,” Ulrich continued. “Dual tracking and agile ways of working will be key to resolving operating model obstacles. Companies should have an eye toward quick-win projects that create value in weeks, not months, while also delivering on future strategic goals, like establishing a digital foundation and governance to measure results. And they should be prepared to move on from initiatives which don’t show promise.”

Establishing robust governance and metrics

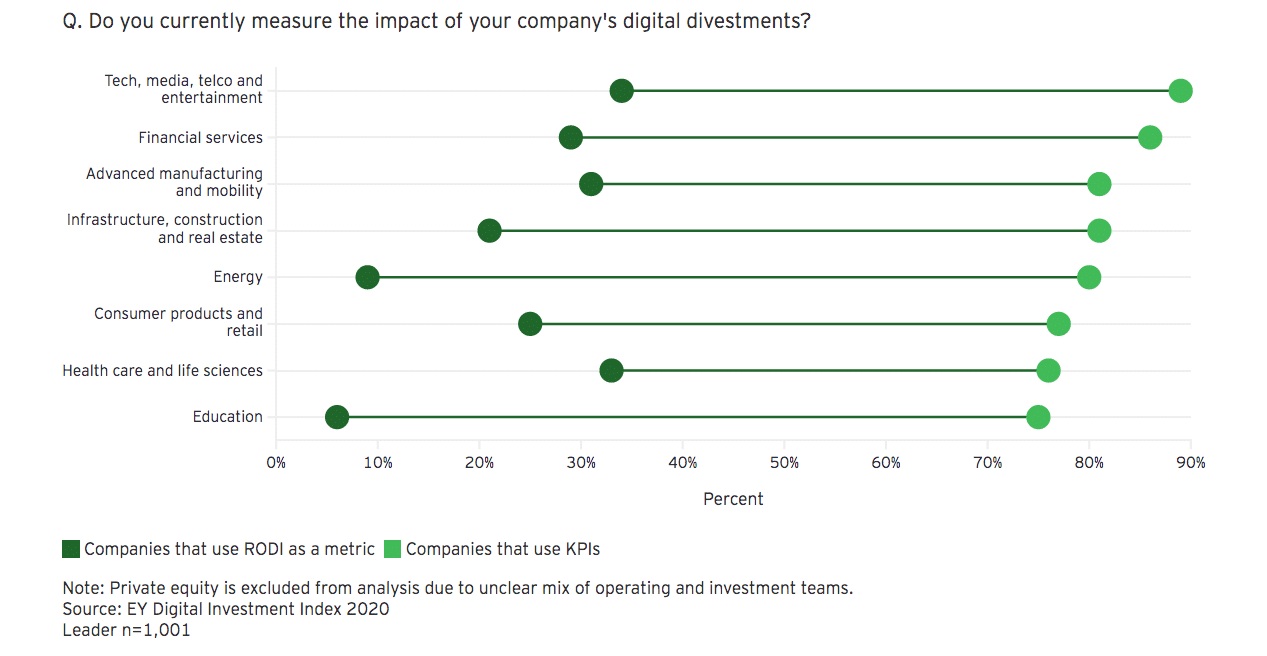

There’s room to improve on defining how digital transformation has benefited business. Although more than 75 percent of executives say that digital initiatives have been a key component of success in the past two years, less than 25 percent actively measure RODI. Other key performance indicators, such as those tied to financial performance (57 percent) and operational efficiency (46 percent), are more prevalent.

“Companies that use RODI as a metric were more likely to achieve greater than 5 percent RODI in 2019, and were better equipped to make informed, strategic decisions,” said Bhatia.

Over half of executives, however, say that RODI is difficult for their companies to assess because it requires a clear strategy, leadership alignment and the right mix of skillsets, tools and data to measure results.

Bhatia added, “You need to show stakeholders effective and frequent measurement of your digital program. Returns increase as leadership prioritizes scale and metrics.”

Measuring RODI may lead to higher returns:

The EY Digital Investment Index gauges how organizations will need to transform to realize their digital strategy over the coming two years. The survey queried 1,001 executives from Europe, North America and Asia from a broad range of industries at companies with more than $1b in revenue. One-third of companies had annual revenues of over $10b. The survey represents CEOs, CDOs (Chief Digital Officers), CFOs, CSOs and CIOs from industries including advanced manufacturing and mobility (AM&M), consumer education, energy, financial services (FS), health care and life sciences, private equity, technology, media and entertainment, and telecommunications (TMT).