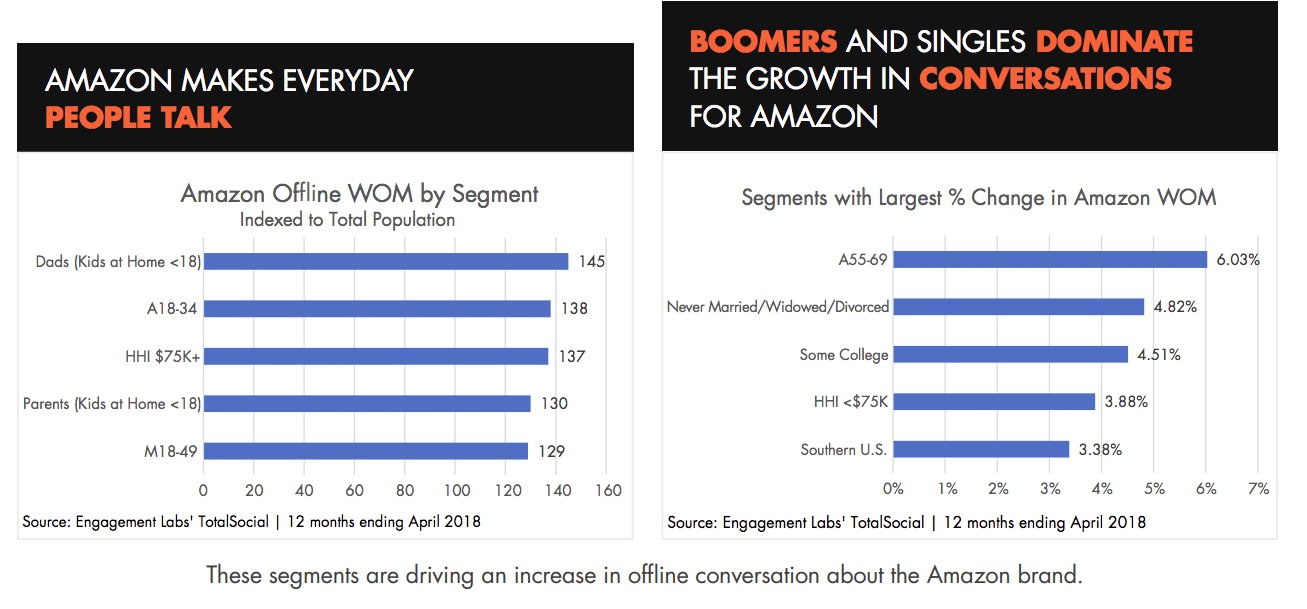

As any brand communicator knows, Amazon’s impact on the retail industry is undeniable—each and every retailer now competes with the e-commerce giant. And rightfully so, according to new research from Engagement Labs—Amazon dominates consumer conversations, and is the focus of more consumer talk than any other retail brand, which equates to increased sales.

In a recent study, Engagement Labs proved that conversations about brands drive 19 percent of U.S. consumer purchases, on average—representing between $7 and $10 trillion in annual sales. As a formidable competitor across every retail category, it is imperative for retail marketers to leverage strategies that motivate consumers to talk about their brands.

According to the new analysis of offline (face-to-face) and online (social media) consumer conversations, many retail brands are doing well—and in some cases, even better than Amazon—in certain conversational categories. With a greater understanding of the power of consumer talk, as well as a holistic view of online and offline consumer conversations, retailers can more effectively stand up against Amazon in the battle for social influence and market share.

“While it is obvious that Amazon is redefining the retail industry, there is still tremendous opportunity for retailers to compete,” said Ed Keller, CEO of Engagement Labs, in a news release. “Our research found that several retailers outperform Amazon in offline conversation—which is equally important in driving consumer sales as the conversations happening online. By understanding consumer conversations, and optimizing marketing campaigns based on this data, retailers have the opportunity to increase their marketing ROI and revenue.”

The study is based on the company’s TotalSocial score, which combines online social media listening data with offline word-of-mouth tracking to provide marketers with a complete view of consumer conversations about their brands. Together, these are proven to be key drivers of sales. According to the study, brand marketers can learn from different retailers across categories to better measure up against the online shopping behemoth.

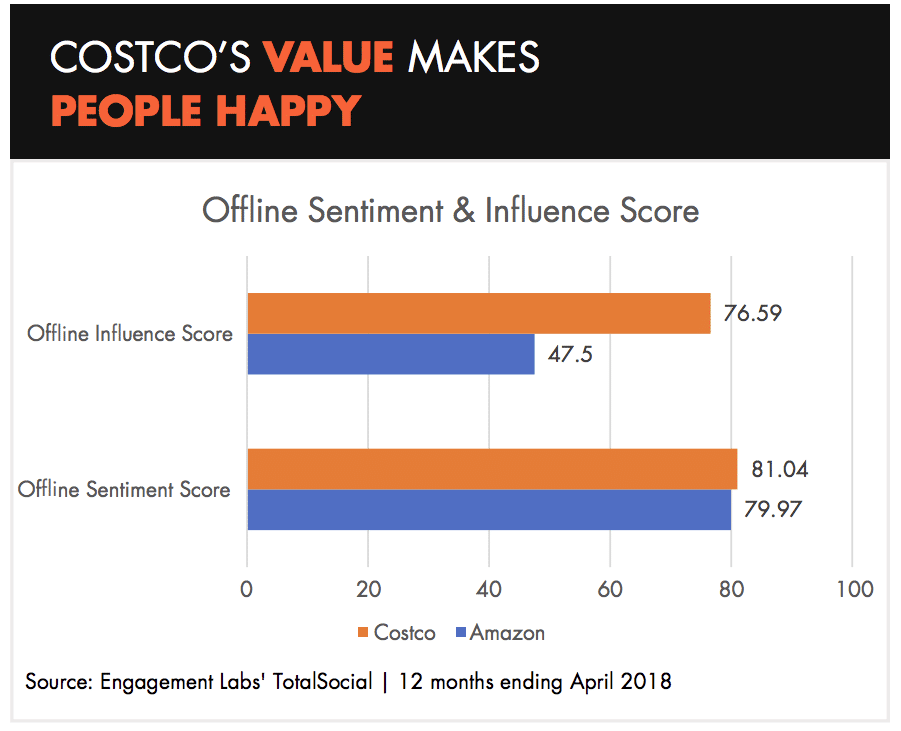

Discount stores

- Costco: In the discount stores category, Costco’s strong TotalSocial score places it second (after Amazon) with high offline scores for volume (how much the brand is being talked about), sentiment (how positive the conversation is) and influence (how well the brand connects with the everyday influencers). In fact, Costco’s offline sentiment and offline volume scores surpass Amazon’s. Costco’s consistent focus on wholesale prices and quality merchandise is a strategy that resonates with its members in their offline conversations. However, the report found Costco does not perform as well online, revealing an area for improvement for the brand.

- Target: Target has a stronger TotalSocial online score than either Walmart or Costco, and it ranks just behind Amazon with a very competitive online sentiment score. Target’s success in sparking online conversations is driving e-Commerce sales for the brand.

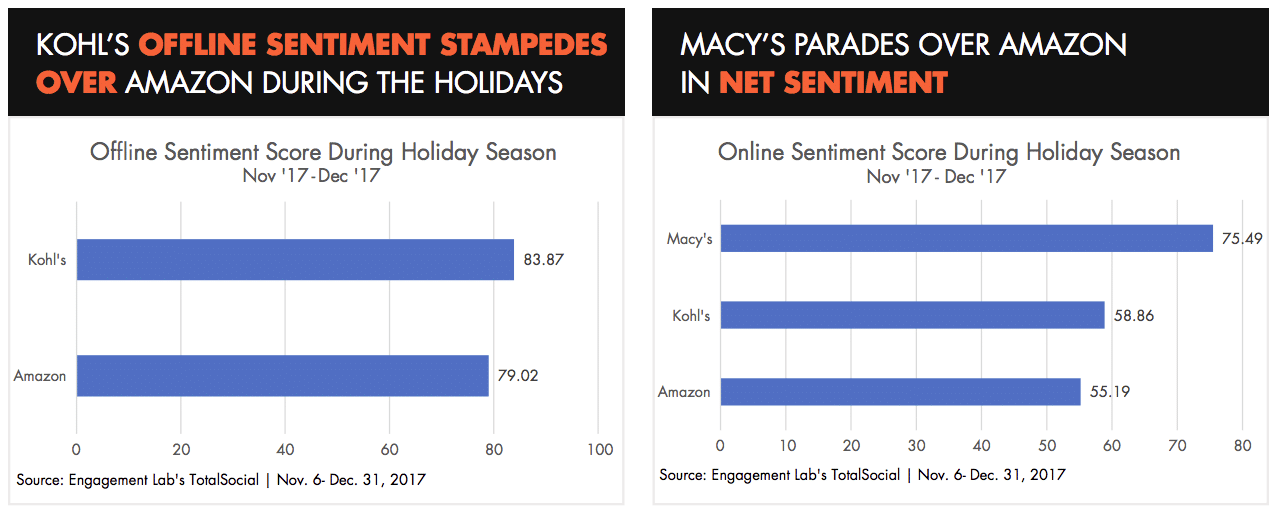

Department stores

- Macy’s: A retailer’s entire year is often determined in the months leading up to the holiday season, and according to the report, Macy’s surpassed Amazon in online sentiment during this period. In addition, Macy’s online and offline brand sharing scores—the extent to which people are sharing or talking about a brand’s marketing or advertising—are a close second to Amazon’s, and the retailer has higher offline and online influence scores than Amazon, indicating that more influential consumers are talking about Macy’s than Amazon.

- Kohl’s: The analysis finds that Kohl’s has such strong offline sentiment that it’s a close second to Amazon throughout the year, but similarly to Macy’s, it surpasses Amazon for offline sentiment during the critical holiday shopping season. Over the last several years, Kohl’s has invested in an aggressive omnichannel strategy which motivates brand sharing and both online and offline discussion. For example, mobile now accounts for 67 percent of its online traffic.

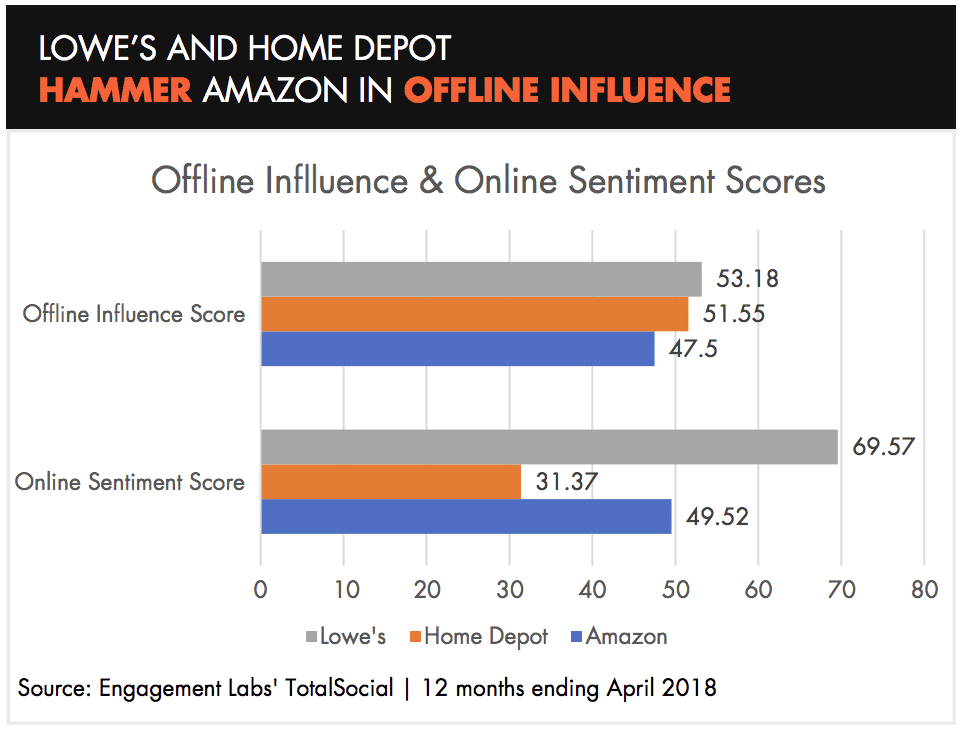

Home center / hardware stores

- Lowe’s and Home Depot: Both have created experiential marketing campaigns that motivate consumers to talk, leading to strong offline volume and sentiment. Lowe’s ranks higher than Amazon in online sentiment, and both retailers rank higher than Amazon in offline influence, largely due to the fact that when consumers look to make home improvements they seek recommendations from the influencers in their everyday lives.

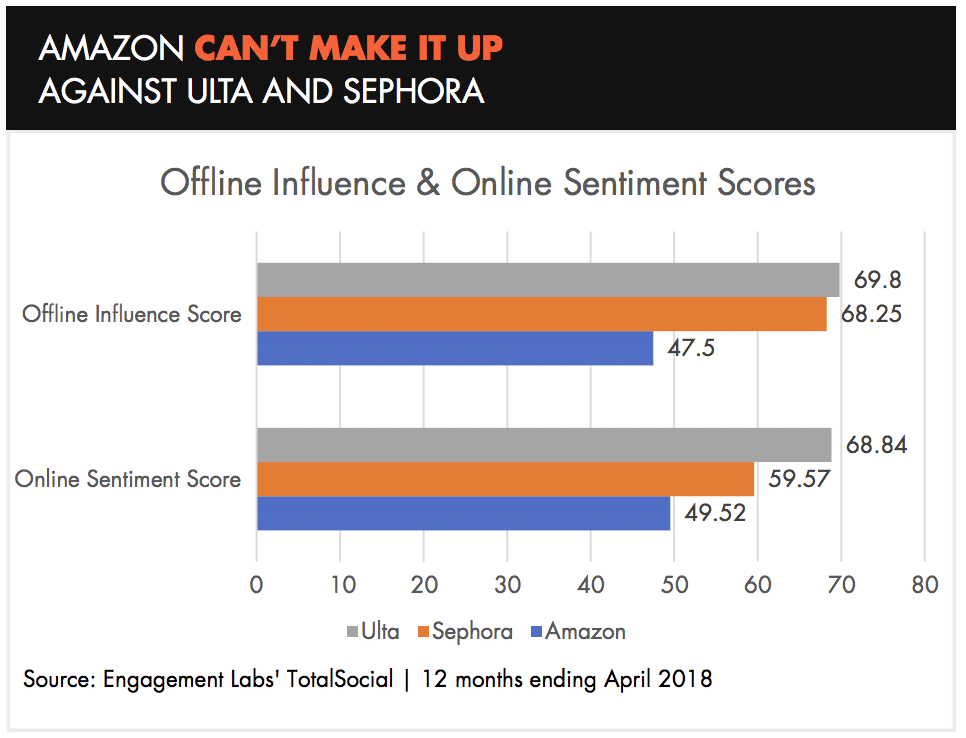

Specialty stores

- Sephora and Ulta: Beauty products are intensely personal, and Sephora and Ulta understand this. They have created experiential marketing to encourage shoppers to visit the stores, try the products, and then purchase.

This approach has motivated consumers to talk about each brand. Sephora has the second highest overall TotalSocial score in the beauty category, behind Amazon. Ulta takes third place. In addition, both brands have higher online sentiment and offline influence scores than Amazon. Ulta also surpasses Amazon in offline sentiment, while Sephora ranks first for offline brand sharing.

“Each conversation metric can impact sales for retail brands,” said Keller. “To better compete, retailers should think about ‘talkability’ when creating their marketing campaigns. By activating consumers to talk positively and share their content offline and online will impact their ability to compete in a rapidly changing retail environment.”

Download Engagement Labs’ e-book, “5 Ways to Beat Amazon” here.