Over the next few months, Katie Paine will be presenting a series titled “How do you measure success?” The Measurement Queen’s series, devoted to examining how PR measurement can be applied to various aspects of public relations to prove their impact, will appear exclusively on the Agility PR Solutions blog.

This is the first in the series.

PR measurement is a criminally underused tool in the PR pro’s arsenal. It’s as though we’re either too inexperienced or too baffled to use it. And all too often, we don’t even realize that it can be applied to almost everything we do in our professional capacity. Events included.

One question I hear a lot is, “How do I measure the event I just did?” The short answer is, of course, you can’t. You can’t measure an event once it’s over; event measurement needs to be baked into the event itself.

Whether the goal of the event is leads, getting a message across, or changing perceptions about your organization, as you plan the event, you need to include some mechanism to collect data. If the reason for the event is generating coverage, you need to set up a media monitoring program before you announce the event.

The other problem with measuring events is that all too often there’s a demand for ROI when a clear definition of what the “return” should be is never decided on.

But after three decades of working in the trenches of PR measurement, I’ve come up with a few solutions to event measurement. It all starts with defining your objectives.

Objective #1: Getting your message across

Many PR events are intended to get a message across – whether it’s the announcement of a new product or a “thought leadership” event – with the goal being to get attendees to leave the event thinking differently about the organization. Firth things first: you need to know how they think about you before the event.

Start with a pre-event survey of the target audience. Keep it short and simple. No more than five questions, one of which should absolutely be, “Are you planning on attending this event?” The rest should probe their perceptions of your brand, questions like, “What do you think of when you see our logo?” and “Would you recommend us to a peer?”

Next, you need to make sure you successfully communicated your message at the event. A quick way to check is to create a hashtag and follow the tweets to see what kind of pickup you earned on social media.

Also, set up a media monitoring program to determine if the media has picked up on any of your messages, and develop a media quality score that quantifies what “good coverage” vs “bad coverage” looks like.

If it’s a competitive event, calculate your share of desirable event coverage and hashtag use compared to the other vendors.

Finally, about two weeks after the event, repeat the survey to measure whether you changed anyone’s mind. Like benchmarking, a survey’s true value comes in repeating it.

Of course, none of these methods translate the results of your event into bean-counter speak. To talk the CFO’s language, you need to deal in resources.

If possible, add up all the various costs of your events during the last quarter. If you don’t have the actual costs, use a resource intensity score – ie. using a scale of “easy-peasy” to “required everyone to pull all-nighters”, rank your events based on how much time and effort they took to organize/attend.

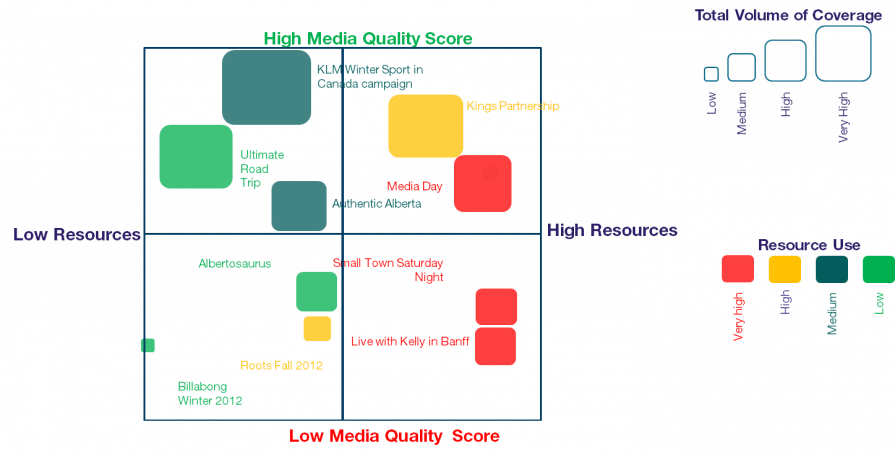

This will allow you to produce a chart like this:

The size of the box indicates the volume of coverage, the color indicates resource intensity, and the vertical axis is the quality of the media coverage.

In one glance, you can see that the events in the lower right quadrant required a ton of resources, but delivered very little quality media coverage, whereas the events in the top left corner delivered far more value for the effort.

Objective #2: Increasing trust

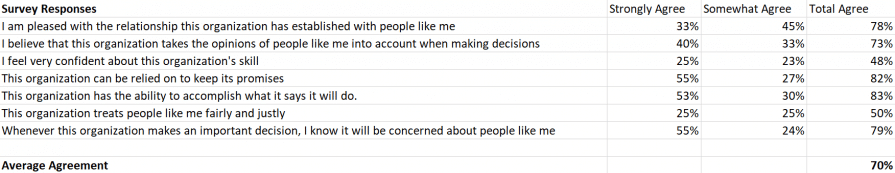

If your goal is building relationships and increasing public trust in your brand, you will need to develop a standard set of questions to establish the attendees’ current level of trust. The seven questions from the Grunig Relationship Instrument, shown in the table below, are an excellent place to start.

The percentage of attendees that agree with these statements becomes your trust score – in this case, 70%

If you ask the same questions after each and every event, you can then compare and contrast the effectiveness of different events at increasing trust.

Objective #3: Increasing cost efficiency

This is essentially an event version of CPM. Start with your sales department and find out what it typically costs for a salesperson to visit a customer or prospect. A general average today is probably around $500 when you add up training, travel, materials, and prep time. With luck, a typical meeting lasts 30 minutes. This boils down to about $16 per minute.

A tech company we worked with sponsored a cruise around a sporting event that put their top sales people in conversations with their top 50 customers for an hour and a half. That was 90 minutes with 50 customers, or a total of 4,500 customer minutes. The cruise and sponsorship cost $5,000 so the cost per minute spent with customer was $1.11 – or 14 times more cost effective.

Framing your events around costs and measuring against them is a surefire way to get C-suite buy-in.

Objective #4: Increasing qualified leads

If you know what an average sale is worth, you can come up with a good proxy for value produced as a result of a customer or lead-generation event. You’ll need a good method to capture leads and qualify visitors. A key question should be, “How likely are you to purchase a product in the next six months?”

Now take the percentage of leads that indicate they are likely to purchase within six months and multiply it by the total number of people that visited your event or booth. That’s the percentage likely to purchase. Multiply that number by the average price and profit for whatever products or services you are selling at the show to get an indication of the sales potential of the show.

Again, CFOs love it when you can equate event successes to actual revenue.

Objective #5: Increasing customers

A country music cable company was sponsoring country music concerts in Wal-Mart parking lots. At first, all they counted was how many people showed up. But then the finance department questioned the value of the efforts, since the goal was to increase demand in local markets and, specifically, to convince attendees to call their local cable company and sign up.

We used a sweatshirt giveaway at the events to collect names and addresses of attendees, whom we called two weeks after the event, asking them whether they’d be willing to call the local cable company and request that it add the country music channel to its lineup. Our surveys showed that 93 percent of attendees were willing to take some action and 89 percent were willing to make a phone call to their local cable company.

When it comes to event measurement, there’s simply no substitute for hard numbers.

For more tips, read Katie’s 6 steps for event measurement and download her checklist.