Brands and retailers are hoping for big holiday-shopping dollars in 2023, after recession fears and inflation realities curbed spending for many throughout the year. New research from digital experience software firm Sitecore finds that the spenders are out there, but it’s the smartest and most prepared that are well poised to thrive and survive this holiday season.

The firm’s third annual U.S. Holiday Report, based on a survey conducted by research partner Advanis, reveals that nearly 1 in 3 American shoppers will spend more money this holiday shopping season (29 percent) and have already started spending and shopping earlier this year (28 percent)—and that the retailers who got an early start on delivering gift-giving experiences and building targeted content that meets the desires of potential customers should fare well in 2023.

Spending patterns in focus

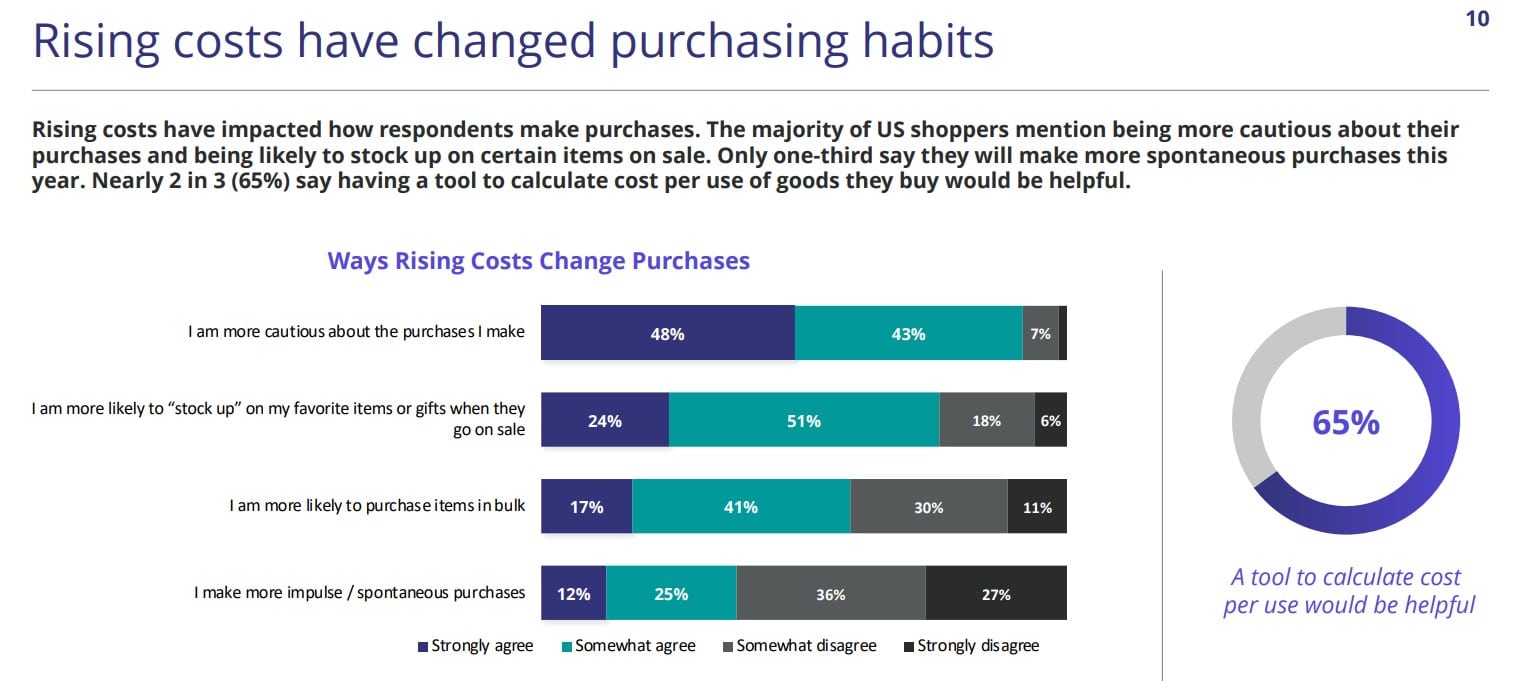

Given the shaky economy, a near equal number of shoppers (26 percent) are more cautious about their purchasing this year and plan to spend less. In fact, almost half (43 percent) say they’ve already started saving to afford the holiday. Therefore, it’s more important than ever for brands to build profiles of their customers to better understand concerns and avoid any cases where promoted products aren’t relevant to shopper needs.

To make the holiday more affordable, consumers are looking for ways to cut back their expenses and subscriptions (55 percent), taking on side gigs (28 percent) and selling items they own to make extra money (23 percent). One in five (19 percent) will even re-gift items, and nearly 3 in 4 will buy cheaper (74 percent) and fewer (69 percent) gifts this year.

When it comes to determining how (and where) they’ll spend their money with brands this holiday season, shoppers will prioritize early discounts and deals (68 percent), online-only discounts and deals (59 percent) and exclusive pre-sale deals for loyal customers (38 percent). Promotional content needs to reflect the economic realities by offering targeted discounting, lower-price alternatives and even curated vintage items.

“While we expect many consumers will spend less as they’re still reeling from the financial impact of inflation, we do expect to see higher spending this year compared to last year,” said Hannah Grap, interim CMO at Sitecore, in a news release. “But this increased spending doesn’t come without strings attached for brands. Consumers will do their homework to keep tight control over their spend and will be selective in what and who they spend their money with this season. Brands must understand their purchasing habits and preferences to win over buyers—and they must build content and experience strategies that reflect these preferences.”

“Offering up discounts on big ticket luxury items won’t be appreciated by customers tightening their belts. In fact, doing this may even be brand damaging,” said Grap. “Time-poor and cash-strapped consumers will shop with the retailers who showcase the things they want at the price-points they need through an online experience that is intuitive, easy to engage with and exciting. [The report] reveals that the customer experience matters and things like showing shoppers item availability, offering free shipping and implementing direct-to-purchase options on social media could give brands an edge over competitors.”

Additional findings from the report include:

Free shipping or bust

Two in three (67 percent) won’t purchase an item that doesn’t offer free shipping and 84 percent will fill carts to meet minimum free shipping requirements.

Inventory frustration and FOMO

Two in three (67 percent) have purchased items only to be told after their purchase it isn’t available—and that doesn’t sit well with shoppers. When shopping this season, 78 percent say they want to see inventory levels to understand what products are available. If they know an item is low in stock, it will lead them to purchase it right away (43 percent) or put it in their cart (26 percent).

A TikTok and Instagram inspired holiday

Two in five (41 percent) say they’re influenced by holiday ads to decide what and where they purchase gifts. Of those who say they are inspired by social media, TikTok (62 percent) and Instagram (67 percent) are the top channels of inspiration to decide the gifts they’ll purchase this year. Consumers are also just as likely to trust Amazon gift recommendations (43 percent) over recommendations made by family and friends (48 percent). The trust in gift recommendations from Amazon aligns with shopping habits, as nearly three in five (58 percent) consumers say they’ll shop from Amazon the most this season compared to purchasing directly from a brand’s website (34 percent).

Functional, experiential and sustainable

Americans’ top gift choices this year will be functional (81 percent), sustainable (75 percent) and experiential (54 percent). Additionally, subscriptions (39 percent) and learning experiences (33 percent) will be popular gift choices.

Online shopping is still king

Just 1 in 5 (20 percent) plan to do more of their holiday shopping in-store. While consumers plan to do more online shopping this season (47 percent), they do plan to visit stores in-person to research and browse for items (38 percent).

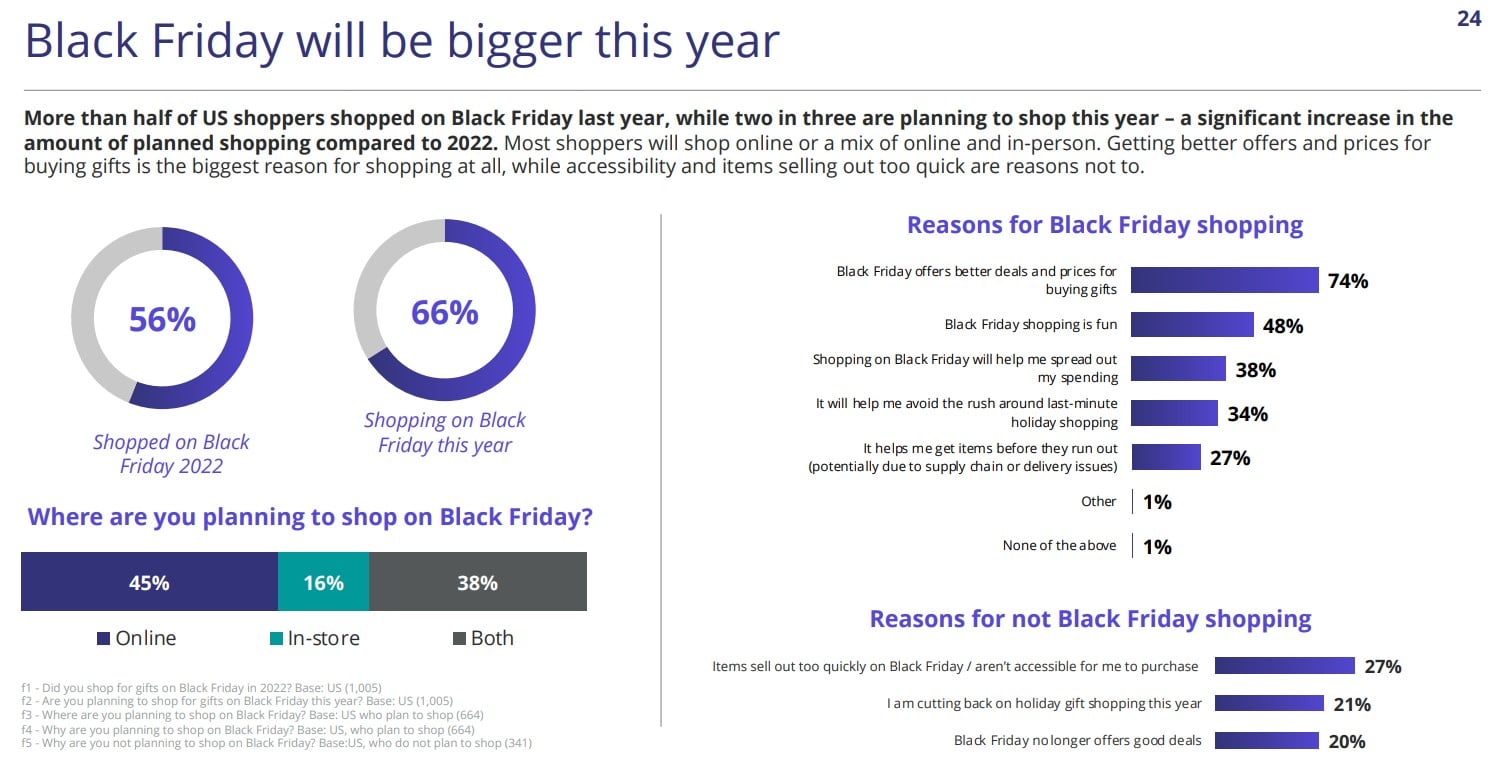

Black Friday expected to be bigger this year

Two in three (66 percent) plan to holiday shop on Black Friday, which is a higher number of people who shopped in 2022 (56 percent). Nearly half will shop online only (45 percent) and 2 in 5 (38 percent) will shop online and in-store. Beyond the fact that it’s just fun to shop on Black Friday (48 percent), most shoppers (86 percent) say it’s more financially advantageous to shop during Black Friday and it helps them avoid last-minute shopping (34 percent).

Download the full report here.

Sitecore commissioned Advanis to conduct a survey among U.S consumers reflecting on holiday shopping behaviors. The study polled 1,005 U.S. consumers in September 2023.