New research from loyalty and engagement research consultancy Brand Keys reveals a significant sorting-out of brands by consumers when it comes to loyalty in the post-pandemic marketplace. A significant re-distribution of brand loyalty was identified in the firm’s 14th annual Brand Loyalty Leaders survey.

For 2022, 1,624 brands in 142 categories were examined in the Loyalty Leaders List, which reveals best-practice guidelines for nurturing customer loyalty, yielding stronger bottom line performance. “The 2022 brand loyalty rankings are leading-indicators of what a return-to-normalcy marketplace will look like in the coming months,” said Robert Passikoff, Brand Keys founder and president, in a news release.

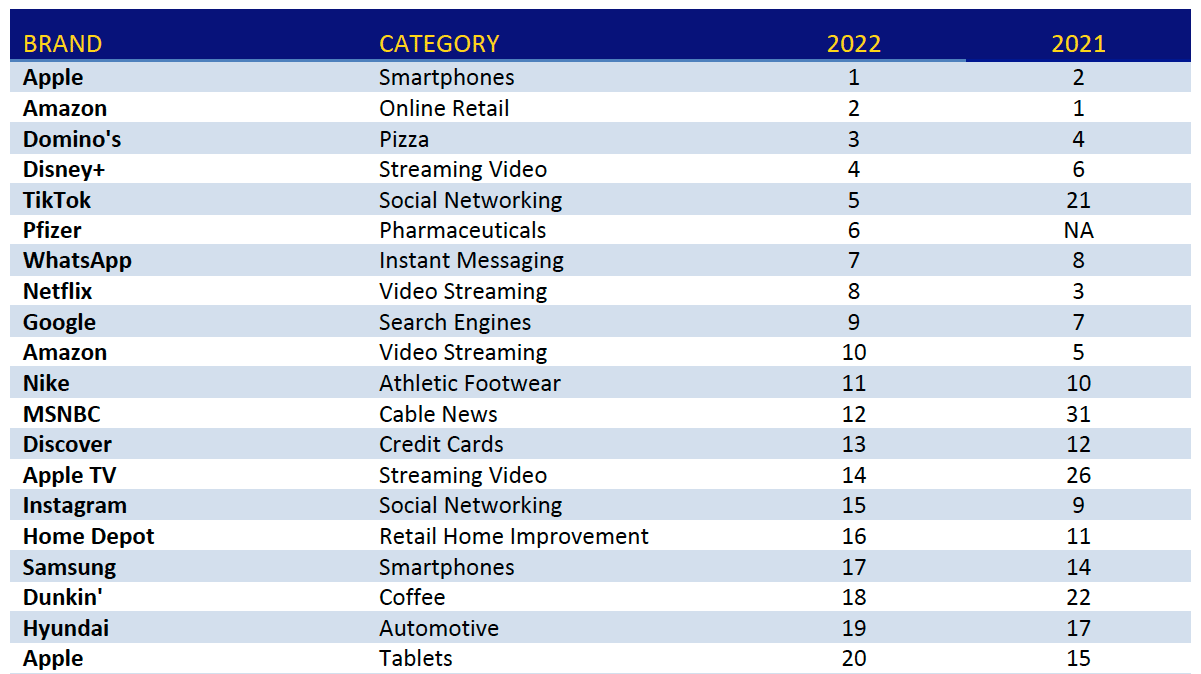

The 2022 Top 20 brands on the Loyalty Leaders list

Consumers ranked this year’s Top 20 Brand Keys Loyalty Leaders as follows:

Categories making up 2022’s Top 100 brands

This year, some sectors saw more loyalty than others. Half the brands (51 percent) on the list fell into three general categories:

- Retail (22 percent)

- Food & Beverages (16 percent)

- Technology (13 percent)

The remaining Loyalty Leaders were represented by brands in Consumer Packaged Goods and Entertainment (11 percent each), Automotive (9 percent), Financial (8 percent), and Social Networking (7 percent).

Six brands are new to the list

Shared and intersecting consumer values—critical behavioral indicators—led consumers to “promote” six new brands to the Top 100 Loyalty Leaders:

- Beyond Meat and Impossible Foods

- Moderna and Pfizer

- Paramount +

- Tesla

“Brands first entering the top 100 are early-indicators of consumer value migration,” said Passikoff. “Plant-based meat substitutes and electric vehicles, while different sectors, represent similar values other brand categories should attend to. It’s hard to miss precedents as regards sustainability, greening and new pharmaceutical brands ties to health and wellness.”

Loyalty leaders—and losers

“Loyalty is never unalterable, which is why it’s critical for brands to monitor movement within the Loyalty Leaders List,” added Passikoff. “A brand’s change in loyalty-rank always predicts future consumer behavior. The stronger the loyalty bond, the higher on the list, the more positive consumers’ behavior. Better behavior always equals a better bottom line. The pandemic and supply chain issues have had their moment-in-time effects, but loyalty always wins in the end.”

The dozen brands with largest loyalty-list gains this year included:

- State Farm (+25)

- MSNBC (+19)

- Costco (+18)

- McDonald’s (+17)

- TikTok and Sam’s Club (+16 each)

- com (+15)

- Apple TV and Chobani (+12 each)

- Dollar Tree and Mattel (+11 each)

- Levi Strauss (+10)

The dozen brands that saw greatest losses in customer loyalty-rank included:

- Purell (-52)

- Clorox (-41)

- Lowe’s (-23)

- Facebook (-17)

- New Balance (-14)

- Spotify (-13)

- Lyft (-12)

- Ralph Lauren (-11)

- Jeep, Starbucks, Call of Duty, and Budweiser (-10 each)

Why consumers are loyal to your brand

“Loyalty is about emotional brand connection and consumers’ mostly-emotional expectations. Connect and meet expectations and your brand will always do better in engagement, consideration, and purchase,” said Passikoff.

The research demonstrates that brands with high levels of loyalty can emerge from pandemic flashpoints and economic rollercoasters stronger than before. Brands that make loyalty, engagement and consumer expectations a priority not only appear high on the Loyalty Leaders List; more importantly, they show up high on consumers’ shopping lists.

See the full Top 100 brands list here.

Brand Keys Loyalty Leaders analysis was conducted during August 2022. It includes 68,125 assessments (M/F, 16 to 65 YOA). Respondents self-selected categories in which they are consumers and then assessed brands for which they were customers, assessing a total of 1,624 brands in 142 categories.