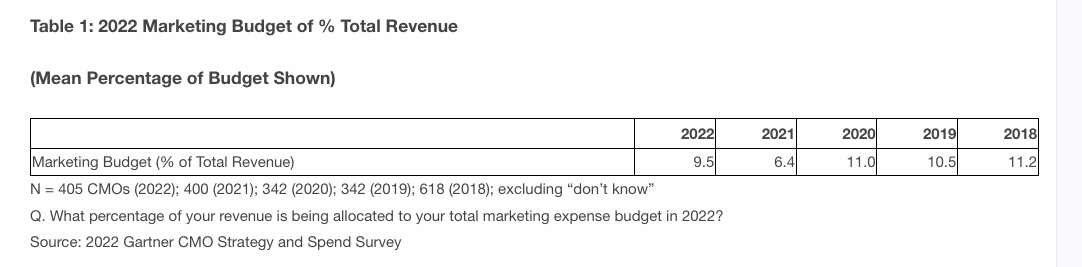

Following two years of precarious budgeting in a volatile, if not hostile marketplace, marketing budgets have climbed to 9.5 percent of total company revenue in 2022, an increase from 6.4 percent in 2021, according to Gartner. But while marketing budgets are increasing this year, they still lag pre-pandemic spending levels.

“In the face of telling macroeconomic considerations, CMOs hold on to a belief that their own economic outlook is strong,” said Ewan McIntyre, chief of research and vice president analyst in the Gartner for Marketing Leaders practice. “Despite inflation, the Russian invasion of Ukraine, supply chain issues exacerbated by China’s lockdown measures and unprecedented talent competition, CMOs appear sanguine. For example, the majority of CMOs surveyed thought inflationary pressures hitting their business and their customers will have a positive impact on their strategy and investment in the year ahead.”

Seventy percent of respondents reported their budgets had increased this year, however with marketing budgets increasing to 9.5 percent of total company revenue, it is still down from the average budget between 2018 and 2020 of 10.9 percent.

Digital accounts for 56 percent of marketing spend, but offline channels rebound

CMOs have made the shift from digital-first to hybrid multichannel strategies. When asked to report the proportion of their 2022 budget allocated to online and offline channels, online channels take the largest share (56 percent). However, offline channels account for almost half the total available budget (44 percent)—a more equitable split than in recent years. Looking at the average spend across industries, social advertising tops the list, closely followed by paid search and digital display.

“There has been a lot of discussion around COVID-19 shifting consumers to a digital first mindset. However, as Western Europe and North America relax pandemic protocols, customer journeys have recalibrated,” said McIntyre. “Post-lockdown, CMOs need to listen carefully to their customers and pay attention to the channels they are using, as this more closely resembles a hybrid reality.”

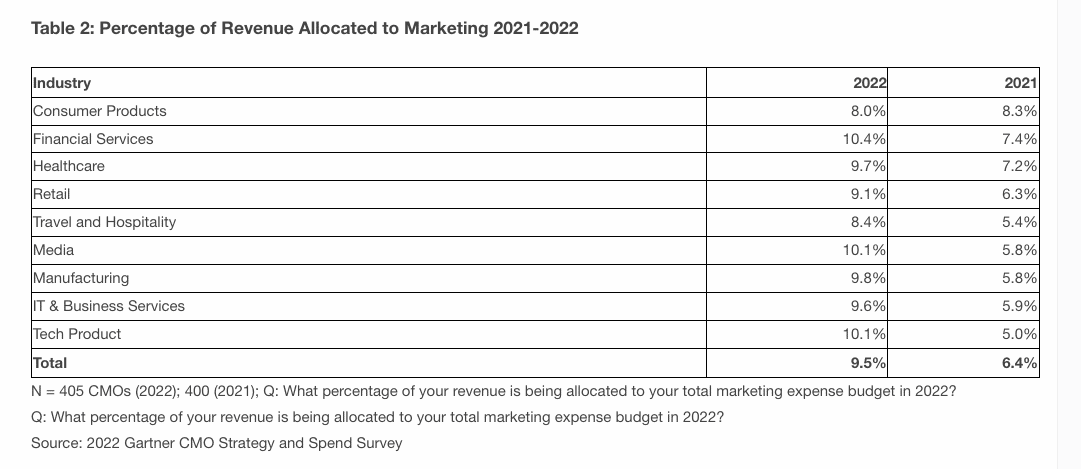

Marketing spend increasing across nearly all industries

Average marketing spending has increased across almost all of the industries surveyed, with some significant variances. Financial services companies recorded the highest budget, at 10.4 percent of company revenue, up from 7.4 percent in 2021. While eight out of the nine industries surveyed reported budget increases, spending for CMOs in consumer goods firms has stagnated, moving from 8.3 percent in 2021 to 8 percent in 2022.

CMOs confident on brand capabilities, but 58 percent lack in-house resources

Brand was one of the lowest ranked capability gaps in the survey, showing that CMOs are confident in their capabilities to manage brands. In fact, when asked to report their budget allocations across marketing’s program and operational areas, brand strategy and activation are near the top of the list, accounting for nearly 10 percent of the budget. However, other strategic capabilities gaps still persist: Marketing data and analytics was identified by 26 percent of CMOs as a top capability gap, followed by customer understanding and experience management (23 percent), and marketing technology (22 percent).

These specific instances illustrate a larger resource challenge for CMOs, with the majority (58 percent) of CMOs reporting that their teams lack the capabilities required to deliver their strategy.

“Marketing is experiencing a historic surge in talent demand in 2022,” continued McIntyre. “Prioritizing the proper mix of resources should be a mission critical priority for CMOs in order to attract and retain the capabilities they need to deliver against their CEO’s goals, such as focusing on brand and customers.”

Learn more in the upcoming complimentary webinar, “The Gartner CMO Spend Survey 2022: The State of Marketing Budget and Strategy.”

The annual Gartner 2022 CMO Spend and Strategy Survey was conducted between February through March 2022 among 405 CMOs and other marketing leaders in North America, as well as Northern and Western Europe across different industries, company sizes and revenue, with the majority of respondents reporting annual revenue of more than $1 billion.